research – Page 23

-

Article

ArticleGovernment launches review of taxation on travel and subsistence expenses

The government has launched the first stage of its review into the taxation of travel and subsistence expenses, which it announced in the 2014 Budget in March.The consultation follows the Office of Tax Simplification’s (OTS) report, Review of employee benefits and expenses: second report, which was published in January 2014.The ...

-

Article

ArticleBank of England consults on bankers' bonuses

The Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) have published two joint consultation papers aimed at improving individual responsibility and accountability in the banking sector.One of the consultation papers, Strengthening the alignment of risk and reward: new remuneration rules, include proposals for the introduction of new rules on ...

-

Article

ArticleEAT to hear three cases on holiday pay

The Employment Appeal Tribunal (EAT) is to hear three cases on holiday pay on 30 July.The hearing follows two recent decisions around holiday pay.In June 2014, the European Court of Justice (ECJ) ruled that an employee who dies with outstanding holiday pay should be paid this after their death.In May ...

-

Article

ArticleHMRC launches consultation on unapproved share schemes

HM Revenue and Customs (HMRC) has published a consultation on one of the Office of Tax Simplication’s (OTS) share scheme recommendations.Its consultation, Office of Tax Simplification review of unapproved share schemes: marketable security, looks at a recommendation made by the OTS in January 2014 that the government introduce the concept ...

-

Article

ArticleGovernment proposes halving deferred state pension increase

The government has proposed halving the deferred state pension increase rates from 6 April 2016.Currently, UK workers who reach the state pension age before 6 April 2016 will be able to defer their state pension and benefit from an annual increase of 10.4% on the deferred income.Under the proposals, anyone ...

-

Article

ArticleYachts, jewellery and clocks give rise to benefit in kind

The First-Tier Tax Tribunal has ruled that the use of yachts, jewellery and clocks ‘placed at the disposal’ of an employee gives rise to a benefit in kind.In the case, Gillian Rockall v HM Revenue and Customs (HMRC), Rockall and her husband were the directors and controlling shareholders of two ...

-

Article

ArticleObesity could be covered by anti-discimination law

Employers could be legally required to bear the costs of all necessary reasonable adjustments to accommodate the needs of severely obese employees after an opinion delivered by the Advocate-General of the Court of Justice of the European Union (CJEU).The opinion relates to the Danish case, Karsten Kaltoft v Billund Kommune, ...

-

Article

HMRC loses Rangers employee benefit trust appeal

HM Revenue and Customs (HMRC) has lost its appeal in the upper tier tax tribunal in the case around defunct Rangers Football Club plc’s use of an employee benefit trusts (EBT).In November 2012, the first tier tax tribunal ruled in favour of the Murray Group, which had owned the club ...

-

Article

ArticleEAT confirms compulsory retirement at 65 is justified

The Employment Appeal Tribunal (EAT) has confirmed that compulsory retirement at the age of 65 can be justified.More than seven years ago, the case Seldon v Clarkson Wright and Jakes raised a claim of age discrimination because Mr Leslie Seldon was forced to retire at age 65 from the law ...

-

Article

ArticleIndividual savings account allowance rises to £15,000

The annual individual savings account (Isa) allowance will increase to £15,000 from today (1 July 2014).The increase, which was announced in Chancellor George Osborne’s Budget in March, allows staff transferring exercised shares into an Isa from a maturing employee share scheme to protect more of their gains over the tax-free ...

-

Article

ArticleHMRC to raise bonus rates for sharesave schemes

HM Revenue and Customs (HMRC) is to increase the bonus rates payable on five-year sharesave schemes.A new bonus rate of 0.6 times monthly contributions and an annual equivalent rate of 0.39% will be applied to these schemes from 28 July 2014.This is the first time a bonus rate will be ...

-

Article

ArticleGovernment sets out legislation on collective pensions

The government has set out legislation on collective pensions in the new Private Pensions Bill.The purpose of the new legislation, which was confirmed in the Queen’s Speech on 4 June, is to enable employers to develop shared risk, or defined ambition, schemes that offer more certain outcomes for employees, while ...

-

Article

ArticleGovernment launches consultations on simplifying benefits tax

The government has launched four consultations on proposed changes to simplify the administration of employee benefits in kind and expenses.The consultations, which were announced in Chancellor George Osborne’s 2014 Budget in March, follow a review of employee benefits and expenses carried out by the Office of Tax Simplification.The consultations will ...

-

Article

ArticleGovernment sets out minimum wage remit for Low Pay Commission

The government has set out its remit for the Low Pay Commission’s 2015 report.Its aim is to have national minimum wage rates that help as many low-paid workers as possible, while making sure that it does not damage their employment prospects.The government has asked the Low Pay Commission to:Monitor, evaluate ...

-

Article

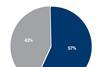

Article57% say removal of pension commission is a positive move

More than half of employers (57%) consider the ultimate removal of pension scheme commission as a positive move, according to Employee Benefits/Lorica 100 Club research 2014, published in June. This is based on 54 respondents to the survey.Also, more than half employers (54%) feel that for generation Z, pensions are ...

-

Article

ArticleDeath of an employee does not end right to holiday pay

The European Court of Justice (ECJ) has ruled that an employee who dies with outstanding holiday pay should be paid this after their death. In the case Bollacke v K+K Klass and Kock, the ECJ ruled that the “right to paid annual leave is a particularly important principle of social ...

-

Article

Article79% of employers support the government’s pension reforms

More than three-quarters (79%) of employer respondents are supportive of the government’s pension reforms, according to research by JLT Employee Benefits.Its research, which surveyed 250 employers and 2,000 UK employees, found that a quarter of employer respondents would amend their pension scheme’s rules to allow flexible retirement, while another quarter ...

-

Article

ArticleUniversity of Wales pays out £460,000 in equal pay case

Nearly £500,000 (£460,000) has been paid out to 18 men in an equal pay case against the University of Wales Trinity Saint David.The group of support staff, which includes plumbers and caretakers, won the case in April 2014, after taking the university to an employment tribunal on the grounds of ...

-

Article

ArticleConsumer Rights Bill to impact salary sacrifice benefits

(Article UPDATED on 24 June 2014: see additional information below)The Consumer Rights Bill (CRB) could impact the provision of flexible benefits schemes and salary sacrifice arrangements.The CRB, which has passed through the House of Commons and has had its first reading in the House of Lords, with a second reading ...

-

Article

Article£4.6m paid out to 22,000 staff in minimum wage arrears

More than £4.6 million has been paid to more than 22,000 employees in wage arrears following investigations by HM Revenue and Customs’ (HMRC) national minimum wage enforcement teams.In the past year, HMRC has conducted 1,455 investigations and issued 652 financial penalties worth £815,269.HMRC found arrears in 47% of cases and ...