News – Page 79

-

Article

Buyer's guide to financial education

What is financial education?Workplace financial education involves employers, or a third-party provider, educating employees about financial benefits, such as pension and share plans, and teaching them how to use these perks to optimise their financial wellbeing. Financial education programmes typically focus on financial benefits, but can also include individual savings ...

-

Article

Philips launches retirement guidance service

Philips UK has launched a financial guidance service to support employees nearing retirement.The service, provided by OpenRetirementClub, is delivered online and via employee forums.The forums feature expert opinion from providers of retirement income and investment services. Employees can then seek specific financial advice or make informed decisions themselves.Nina Platt, reward ...

-

Article

Unaffordable retirement will impact firms' ability to recruit staff

According research by Hymans Robertson two-thirds of respondents to believe that almost half their workforce will be unable to retire at the state pension age due to inadequate pension savings.Its research, conducted among 200 HR directors and managers, found that 78% of respondents have considered the impact this would have ...

-

Article

Lincoln Uni educates staff on personal allowance

EXCLUSIVE: The University of Lincoln is piloting financial education sessions for its senior management to ensure they are informed about their options around the annual and lifetime allowances for pensions saving.The sessions, which are part of the university’s financial education programme with Wealth at Work, started with a session for ...

-

Article

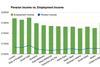

ArticleIncome drop expected for third of retirees

Retirees can expect their regular income to fall by 40%, according to research by annuity provider Partnership.Its analysis of HM Revenue and Customs (HMRC) data also revealed the regions where retirees are most likely to see their income drop, with London (-48%), the east of England (-40%) and the south ...

-

Article

The Platforum publishes workplace savings platforms update

The Platforum has published a workplace savings platform market update for employers.Download Guide for employersThe guide brings together the latest research and feedback from employers and adoptees of the platforms, as well as details of existing and new propositions.With 237 employers using platforms, The Platforum estimates that there are now ...

-

Article

Optimism about retirement low across the globe

Only 12% of respondents globally are very optimistic that they will have enough money to live on when they retire, according to research by Aegon and Transamerica Center for Retirement Studies.The Aegon retirement readiness survey 2013, which polled 12,000 workers and retirees in 12 Asian, European and North American countries, ...

-

Article

AWD Chase de Vere rebrands as Chase de Vere

Independent financial advice firm AWD Chase de Vere has been re-named as Chase de Vere as part of a large re-branding exercise.Stephen Kavanagh (pictured), chief executive of Chase de Vere, said: “We have made huge progress in the past four or five years, transforming our organisation into a high-quality, client-focused ...

-

Article

Pot-follows-member pension launched for film industry

A pot-follows-member group personal pension (GPP) scheme has been launched for the film industry to comply with auto-enrolment legislation.The Film Industry Pension Scheme, which will be operated in partnership between Helm Godfrey and Scottish Widows, is designed to address a series of industry-specific issues when it comes to pension administration, ...

-

Article

Employees not confidant their pension will deliver adequate income

More than half (57%) of respondents are not confident their pension will deliver an adequate retirement income, according to research by consultancy Hymans Robertson.Its research, which surveyed 500 UK adults who save into a defined contribution (DC) pension scheme, found that 23% of respondents do not know how much of ...

-

Article

Employers must change attitude on ageing employees

This follows the report’s finding that 10.7 million people in the UK can currently expect inadequate income in retirement.The report also recommended that the government establish a commission to work with employers and financial services providers to improve pensions and savings.Jonathan Watts-Lay, director of Wealth at Work, said the government ...

-

Article

Premier launches online retirement service

Premier has launched an online retirement service for both employers and trustees.The web-based service, Gateway2Retirement, is aimed at helping employees understand all of their pension options, and guiding them to the right one for them, whether it is an annuity, a drawdown pension or a phased retirement.For instance, if annuity ...

-

Article

JLT Wealth Management launches retirement service

JLT Wealth Management has launched a range of services to ensure that employers can provide their workforce with effective pre and at-retirement advice.The service, called Road to Retirement, supports employees in both defined benefit (DB) and defined contribution (DC) pension schemes.It includes:A pre and at-retirement information pack for all employees ...

-

Article

House of Lords reports on ageing society

More than 10 million people in the UK can currently expect inadequate retirement incomes, according to a report by the House of Lords’ Select Committee on Public Service and Demographic Change.According to the report, Ready for ageing?, the UK will see a 50% rise in the number of people over ...

-

Article

Henderson launches retirement advice

EXCLUSIVE: Henderson Global Investors has introduced employer-funded one-to-one financial advice sessions, targeted at employees who are around 15 years away from retirement.Jeremy Mindell, former senior reward and tax manager at Henderson Global Investors, said: “There’s an element of saying: ‘What are you going to do with your money? Is this ...

-

Article

Wealth at Work launches retirement options service

Wealth at Work has launched a retirement income option service, which is designed to ensure employees maximise their retirement income.The service includes:Financial education, which will ensure employees understand the retirement income options available to them.Internet support tools to help support employees on all aspects of retirement which are easily accessible ...

-

Article

Saving for retirement not top priority

Only one-fifth (21%) of respondents said that saving for retirement was their top financial priority, according to research by Friends Life.Its survey of 1,600 employees over the age of 50, found that this age group is more focused on making ends meet (23%), saving for holidays or leisure activities (15%) ...

-

Article

Financial Education report (March 2013)

Download PDF of Financial Education Report 2013.Stuart Bailey: Target younger staff with financial educationConsequences of the retail distribution reviewRoche finds right formula to raise staff financial awarenessTailor pre-retirement education to employee age groupsFinancial workshops help educate University of Lincoln employeesMarks and Spencer educates staff on savvy savingJonathan Watts-Lay: Employees need ...

-

Article

Padraig Floyd: Financial knowledge is power

Discussing finances with employees is often deemed a futile exercise because half the population does not understand what 50% is.Harsh, maybe, but unfortunately true.The government has finally realised that in order to protect its citizens, and improve the financial services industry in the process, no doubt, people are going to ...

-

Article

Majority of 2013 retirees would continue working

Nearly six in ten (57%) employee respondents retiring in 2013 would consider working past the state pension age, according to research by Prudential.Its Class of 2013 research found that 40% of these respondents would want to work in full-time employment and 60% would consider working part-time.It also found that 55% ...