News – Page 77

-

Article

Retirement plans pushed back four years

Those approaching retirement are pushing back their retirement plans by an average of four years, according to research by pensions and investment provider NFU Mutual.Its research, which surveyed more than 2,000 UK adults, found that one in 10 respondents who are past the age of 55 and still working said ...

-

Article

McCarthy and Stone raises pensions take up by 45%

EXCLUSIVE: McCarthy and Stone has increased take up in its pension scheme by 45% since it launched a workplace savings platform three years ago.The platform, provided by Hargreaves Lansdown, includes access to a self-invested personal pension, independent savings account and investment account.Since the retirement homes developer launched the platform in ...

-

Article

ArticleYoung employees lack opportunities to save

Two-thirds of young employees, who are ready to save for retirement, lack the opportunities to do so, according to research by Aegon UK.Its Changing face of retirement: the young, pragmatic and penniless generation survey, which had 10,800 global respondents, including 2,722 employees between the ages of 20 and 29, found ...

-

Article

Scisys boosts employee pensions engagement

EXCLUSIVE: Scisys Group has seen 85% of its staff register to manage their pension scheme online and 47% opt to select their own investments following the launch of its workplace savings platform.The IT services developer has also seen 30% of employees increase their pension contributions and 35% log-in to view ...

-

Article

41% have not discussed retirement plans with partners

More than two-thirds (41%) of respondents have never discussed how they will turn their pension savings into income in retirement, according to research by Prudential.Its research, which surveyed 1,996 adults over the age of 40 who currently live with their spouse or partner, found that 19% have discussed this but ...

-

Article

Friends Life simplifies death-in-service claims process

Friends Life has simplified its death in service claims process by removing the need for claimants to show an original death certificate.The service, which provides financial support if an employee dies, will now verify the death in service instantly through the government records office.The online tool allows claims to be ...

-

Article

45-to-54 year olds need to rethink pension saving

Pension savers aged between 45 and 54 need to rethink plans for funding their retirement, according to research by investment services organisation BlackRock.Its Investor pulse survey, which questioned 2,000 Britons between the ages of 25 and 74, found that the 45-to-54 age group was the most financially squeezed, with nearly ...

-

Article

Barclays launches new benefits website

Barclays Corporate and Employer Solutions (C&ES) has launched a website dedicated to its workplace savings and financial education product. Barclays Beyond Benefits, which was launched in September, brings together consultancy services, traditional employee benefits, share plans, pensions, financial education and banking services in a single online portal.The website includes:A financial ...

-

Article

Aspire to Retire launches pre-retirement service

Aspire to Retire has launched a pre-retirement service that enables employers to provide employees with access to pre-retirement guidance and advice.Your path to a better retirement aims to educate pension scheme members on their retirement options and engage employees earlier in their approach to retirement.The service includes:A retirement pack containing ...

-

Article

Debbie Lovewell: Pensions reports highlight challenges

Several pensions reports published this week brought some frankly concerning issues firmly back into the spotlight.Firstly, Scottish Widows’ 2013 Women in Pensions report found that just 40% of women are adequately prepared for retirement, while more than a third (39%) have made no pension provision at all. In addition, the ...

-

Article

Jelf promotes Chris Ford and Alan Millward

Jelf Employee Benefits has promoted two directors.Chris Ford (pictured) has been promoted to director of group risk and individual protection. He was previously director of group risk.In his new role, Ford will also be responsible for individual protection services for both the corporate and individual markets.Alan Millward has been promoted ...

-

Article

71% will have to supplement retirement funds

Almost three-quarters (71%) of respondents believe they will need to supplement their income in retirement, according to research by financial services provider Partnership.Its research, which surveyed 2,000 people between the ages of 45 and 65, found that, while 33% of respondents aged between 50 and 65 had put aside savings ...

-

Article

Hertfordshire Council switches staff workshop provider

EXCLUSIVE: Hertfordshire County Council has switched providers of the financial awareness workshops it offers its 33,000 employees.Its new advisor, Affinity Financial Awareness, will provide fortnightly workshops, which will alternate between the council’s main offices across the country.The free financial planning and pre-retirement workshops are available to all employees, who are ...

-

Article

B&Q to launch financial education plan

EXCLUSIVE: B&Q is to launch a financial education programme for employees in November.The DIY retailer’s parent company, Kingfisher, will roll out the programme as a result of auto-enrolment, which has increased participation in its money purchase pension scheme to 17,000 employees, nearly 93% of the workforce.B&Q’s financial education programme, branded ...

-

Article

New financial education provider to launch

A new financial education software provider is to launch in the UK in November.The launch of Nudge is in response to unhealthy finances and money-related stress in the workplace.It aims to improve the lifestyle of individuals by changing their financial decisions via its online software Quantum, which has been developed ...

-

Article

Jelf Employee Benefits acquires stake in Laterlife

Jelf Employee Benefits has acquired a controlling stake in Laterlife, to extend its offerings for employees approaching, at or going through retirement.Laterlife, which specialises in retirement planning workshops, offers a range of support in areas such as addressing retirement hopes and concerns, developing new interests and managing time.The partnership allows ...

-

Article

Employers recognise flexible benefits can boost productivity

Financial and HR directors in UK organisations recognise that an appropriate mix of flexible benefits, which include flexible working arrangements, wellbeing initiatives and long-term financial protection, can boost productivity and wellbeing as well as retain employees, according to research by Unum, the financial protection insurance firm.The survey, which had 1,150 ...

-

Article

Savers more confident, calm and optimistic

Almost half (47%) of respondents who take control and check their finances every month feel confident about their financial future, according to research by Standard Life, conducted by neuroscience research agency Mindlab and appraised by cognitive neuroscientist Dr Lynda Shaw.The Saving in mind report used both electroencephalography (EEG) techniques within ...

-

Article

Pensions could play role in cost of long-term care

Pension schemes could play a key part in meeting the costs of long-term care in retirement in the UK, according to a report by Squire Sanders.The law firm’s white paper, In sickness and in health: reforming pensions and social care, addressed the funding challenges represented by an ageing population.It recommended ...

-

Article

Employers need to target different generations with financial education

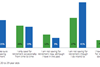

According to the report Talking about my generation: exploring the benefits engagement challenge, published in September by Barclays Corporate and Employer Solutions (C&ES) and Dr Paul Redmond, director of employability and educational opportunities at Liverpool University, 53% of Baby Boomers prioritise saving for retirement, while 41% of Generation X are ...