News – Page 19

-

Article

ArticleIndividual savings account allowance rises to £15,000

The annual individual savings account (Isa) allowance will increase to £15,000 from today (1 July 2014).The increase, which was announced in Chancellor George Osborne’s Budget in March, allows staff transferring exercised shares into an Isa from a maturing employee share scheme to protect more of their gains over the tax-free ...

-

Article

ArticleHMRC to raise bonus rates for sharesave schemes

HM Revenue and Customs (HMRC) is to increase the bonus rates payable on five-year sharesave schemes.A new bonus rate of 0.6 times monthly contributions and an annual equivalent rate of 0.39% will be applied to these schemes from 28 July 2014.This is the first time a bonus rate will be ...

-

Article

ArticleGovernment sets out legislation on collective pensions

The government has set out legislation on collective pensions in the new Private Pensions Bill.The purpose of the new legislation, which was confirmed in the Queen’s Speech on 4 June, is to enable employers to develop shared risk, or defined ambition, schemes that offer more certain outcomes for employees, while ...

-

Article

ArticleGovernment launches consultations on simplifying benefits tax

The government has launched four consultations on proposed changes to simplify the administration of employee benefits in kind and expenses.The consultations, which were announced in Chancellor George Osborne’s 2014 Budget in March, follow a review of employee benefits and expenses carried out by the Office of Tax Simplification.The consultations will ...

-

Article

ArticleGovernment sets out minimum wage remit for Low Pay Commission

The government has set out its remit for the Low Pay Commission’s 2015 report.Its aim is to have national minimum wage rates that help as many low-paid workers as possible, while making sure that it does not damage their employment prospects.The government has asked the Low Pay Commission to:Monitor, evaluate ...

-

Article

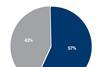

Article57% say removal of pension commission is a positive move

More than half of employers (57%) consider the ultimate removal of pension scheme commission as a positive move, according to Employee Benefits/Lorica 100 Club research 2014, published in June. This is based on 54 respondents to the survey.Also, more than half employers (54%) feel that for generation Z, pensions are ...

-

Article

ArticleDeath of an employee does not end right to holiday pay

The European Court of Justice (ECJ) has ruled that an employee who dies with outstanding holiday pay should be paid this after their death. In the case Bollacke v K+K Klass and Kock, the ECJ ruled that the “right to paid annual leave is a particularly important principle of social ...

-

Article

Article79% of employers support the government’s pension reforms

More than three-quarters (79%) of employer respondents are supportive of the government’s pension reforms, according to research by JLT Employee Benefits.Its research, which surveyed 250 employers and 2,000 UK employees, found that a quarter of employer respondents would amend their pension scheme’s rules to allow flexible retirement, while another quarter ...

-

Article

ArticleUniversity of Wales pays out £460,000 in equal pay case

Nearly £500,000 (£460,000) has been paid out to 18 men in an equal pay case against the University of Wales Trinity Saint David.The group of support staff, which includes plumbers and caretakers, won the case in April 2014, after taking the university to an employment tribunal on the grounds of ...

-

Article

ArticleConsumer Rights Bill to impact salary sacrifice benefits

(Article UPDATED on 24 June 2014: see additional information below)The Consumer Rights Bill (CRB) could impact the provision of flexible benefits schemes and salary sacrifice arrangements.The CRB, which has passed through the House of Commons and has had its first reading in the House of Lords, with a second reading ...

-

Article

Article£4.6m paid out to 22,000 staff in minimum wage arrears

More than £4.6 million has been paid to more than 22,000 employees in wage arrears following investigations by HM Revenue and Customs’ (HMRC) national minimum wage enforcement teams.In the past year, HMRC has conducted 1,455 investigations and issued 652 financial penalties worth £815,269.HMRC found arrears in 47% of cases and ...

-

Article

Article43% expect to have to plug NHS support gap

Some 43% of employers expect to have to plug the support gap created by the National Health Service (NHS) without the government introducing tax breaks on health and wellbeing products and services, according to the Employee Benefits/Lorica 100 Club research 2014.A large majority (85%) of 54 respondents believe tax breaks ...

-

Article

ArticleQueen’s Speech sets out collective DC pension plans

Collective defined contribution (CDC) pension schemes will be included in primary legislation in next year’s pensions bill, announced the Queen during the state opening of Parliament.The Private Pensions Bill would:Make provisions for a new legislative framework in relation to the different categories of pension schemes. It would establish three mutually ...

-

Article

ArticlePersonal allowance increase confirmed

The Queen has confirmed the personal allowance limit will be increased from £10,000 to £10,500 in 2015/16.The increase was first announced in the 2014 Budget in March. It means the first £10,500 of an employee’s annual salary will be exempt from income tax.Consequently, the average basic-rate taxpayer will pay £805 ...

-

Article

ArticleQueen's Speech confirms higher minimum wage penalties

The Queen has confirmed that higher penalties will be imposed on employers which fail to pay their staff the national minimum wage, first announced in January 2014.The Small Business, Enterprise and Employment Bill will introduce an increased penalty of up to £20,000 for employers that do not pay staff the ...

-

Article

ArticleDOD’s blog: Is tax legislation hampering workplace pensions?

Yesterday the Labour party put forward proposals to lower the earnings threshold at which staff will be auto-enrolled into pensions to £5,772. In this way, more low-paid staff would be brought into workplace pensions savings.This follows tens of thousands of employees earning less than £10,000 a year finding that they ...

-

Article

ArticleCourt rules holiday pay should include commission

The Court of Justice of the European Union (CJEU) has held that the Working Holiday Directive should require commission to be taken into account when calculating holiday pay.The finding in Lock v British Gas Trading Limited and others follows the Advocate General’s opinion in the case in December 2013.It means ...

-

Article

ArticleState pension reforms receive royal assent

The Pensions Bill 2013-14, which includes reforms to the state pension, received Royal Assent on 14 May.The reforms, which were first announced in the 2012 Autumn Statement, aim to create a simple flat-rate pension, the full level of which will be set above the basic means test, currently at £148.35.The ...

-

Article

ArticleGovernment to amend definition of money purchase for pensions

The government has published proposed final amendments to the definition of money purchase pension schemes.The Department for Work and Pensions launched a consultation in October 2013 to attempt to clarify the definition of money purchase included in section 29 of the Pensions Act 2011.The consultation followed the Supreme Court’s July ...

-

Article

ArticleDOD’s blog: Should HR get more involved in politics?

On Wednesday I stood for several hours in a queue on Trafalgar Square, London, in order to cast my vote in the South African elections (us overseas nationals get to do it a week in advance of our compatriots back home). The passion, dedication and persistence of people from around ...