News – Page 9

-

Article

ArticleAdvisers respond to global benefits trend

Employee benefits advisers are responding to the growing trend among employers, particularly small and medium-sized enterprises (SMEs), of pooling benefits to achieve global cost efficiencies. For example, Willis Group restructured its global benefits in January, combining its existing employee benefits and related consultancy practices. It did this to develop and ...

-

Article

ArticleBuyer's guide to group income protection 2014

The factsWhat is group income protection (GIP)?GIP pays a regular monthly benefit if an employee is unable to work because of long-term illness or injury. Benefits are payable until the employee returns to work or, if earlier, state pension age. Fixed-benefit term policies are also available, typically for periods of ...

-

Article

Article63% will not have sufficient pension pot by age 65

Almost two-thirds (63%) of respondents believe they will not have a sufficient pension pot by the age of 65, according to research by Canada Life Group Insurance.Its research, which surveyed more than 700 employees, found that 10% intend to continue working past the traditional retirement age to continue receiving employee ...

-

Article

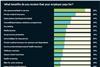

ArticleLife assurance most popular benefit given to HR professionals

This is in addition to salary, bonuses, pensions, share schemes and company cars.The Employee Benefits Salary survey 2014, which questioned 361 people esponsible for managing benefits and reward in UK organisations, found that life assurance is followed by private medical insurance schemes (59%), subscriptions to professional bodies (47%), employee assistance ...

-

Article

Group risk industry paid £1.2bn in claims in 2012

A total of £1.2 billion was paid out by the group risk industry during 2012, according to research by industry body Group Risk Development (Grid).Its research compiled claims statistics to reveal the breakdown of benefits paid out by products, such as group life assurance, group income protection and group critical ...

-

Article

Zurich launches group life assurance for partners

Zurich has launched a group life assurance product for employees’ partners.The product includes:Flexibility for the employer to set the value and number of benefit steps, up to a maximum benefit of £250,000.A simple member acceptance process that operates on a short application form.Cover up to age 75.Nick Homer (pictured), group ...

-

Article

Friends Life simplifies death-in-service claims process

Friends Life has simplified its death in service claims process by removing the need for claimants to show an original death certificate.The service, which provides financial support if an employee dies, will now verify the death in service instantly through the government records office.The online tool allows claims to be ...

-

Article

QVC reduces group risk costs by 63%

EXCLUSIVE: QVC has reduced its group income protection (GIP) costs by 63% over the past three years.The home shopping channel, which has 2,000 employees, had historically provided full-term GIP for the 600 members of its defined contribution (DC) pension scheme.It consulted with Towers Watson’s healthcare and risk consulting practice to ...

-

Article

ArticleClare Bettelley: Lipservice is no substitute for proactive wellbeing support

The Department of Health is ringfencing £50 million to support surgeries that want to extend their working hours, which is an ambitious, some might say foolish, move given the £20 billion worth of savings the NHS has been tasked with making by 2015.And where will the extra doctors come from ...

-

Article

Buyer's guide to critical illness insurance

The conditions covered by CII policies vary between insurers, but core critical illnesses that are typically covered include cancer, heart attacks and strokes. There is also often access to additional cover for other serious conditions.CII policies are relatively easy to implement, and as long as the amount of cover is ...

-

Article

L&G adds stress toolkit to income protection product

Legal and General has enhanced its group income protection product to help reduce the impact of staff absence.It has added a new interactive stress toolkit for line managers, called Prehab Services.The product, which has been developed with charity Rethink Mental Illness, includes:A stress management challenge, which allows line managers to ...

-

Article

Third of respondents unaware of employer's sick pay policy

Nearly 30% of respondents had no idea what their employer will pay them if they have to take sick leave, according to analysis by not-for-profit insurer PG Mutual.The research, which analysed the previously unpublished Pharmacists’ Defence Association (PDA) Survey 2012, which questioned 830 PDA members, found that UK employees are ...

-

Article

ArticleBenefits failing to adapt to changing workforce demographic

Employee benefits have failed to adapt to the changing workforce, leaving UK workers financially exposed, according to research by Cass Business School and commissioned by Unum.The Keeping pace? Financial insecurity in the modern workforce report found that the modern workplace has 13% more female employees, 46% more older employees and ...

-

Article

Group risk premiums up by 9.7% in 2012

Total paid group risk premiums in the UK rose by 9.7% in 2012, according to research by reinsurance provider Swiss Re Group.The organisation’s Group watch 2013 report, which surveyed 43 organisations, revealed that there were some increases in rates, as well as in the overall numbers of lives and schemes ...

-

Article

Legal and General adds face-to-face counselling to GIP

Legal and General has added free face-to-face counselling sessions to its group income protection (GIP) product.Employees covered by a Legal and General GIP policy can have up to five face-to-face counselling sessions if needed.The sessions are offered as part of Legal and General’s enhanced employee assistance programme (EAP), which is ...

-

Article

UK workers unaware of income protection options

More than half (51%) of respondents mistakenly assume their employer would pay full salary for at least three to six months in the event of an illness that prevents them from working, according to research by think tank Demos.The research, Investigating how to protect financial wellbeing during times of austerity, ...

-

Article

Canada Life moves to electronic claims forms

Canada Life started to accept electronic employer claims forms for its group income protection and group critical illness contracts from 1 April.Previously, employers had to complete the claims forms manually and send it via post. The new electronic system will save employers time and administrative effort, as well as getting ...

-

Article

MetLife launches master trust for SMEs

Insurer MetLife has launched a master trust for small and medium-sized enterprises (SMEs).The MetLife Master Trust helps employers insure lump-sum death benefits for staff and their partners to avoid the cost and administrative time involved in setting up their own pension scheme, as well as having to appoint trustees and ...

-

Article

Dairy Crest communicates doctor’s service to staff

EXCLUSIVE: Dairy Crest has rolled out a series of presentations to its 5,300 employees to tell them about the second-opinion doctor’s service that it added to its group income protection (GIP) scheme in 2012.The presentations, which will continue until early May, started with a briefing for 60 staff at the ...

-

Article

Education sector values death-in-service benefits

Two-thirds (66%) of respondents said death in service was the most highly valued benefit in the education sector, according to research by JLT Employee Benefits.Its 2012/13 Survey of employee benefit trends in the tertiary education sector, which polled employers from 73 universities and colleges, found that 25% of respondents said ...