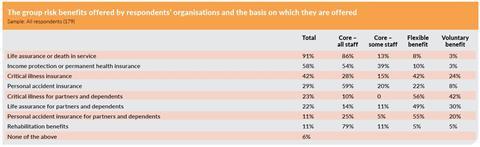

EXCLUSIVE: Approximately nine in 10 (91%) employer respondents provide life assurance or death in service, according to research by Employee Benefits and Staffcare.

The Employee Benefits/Staffcare Benefits research 2017, which surveyed 271 employer respondents in February-March 2017, also found that the majority of respondents that offer life assurance or death in service do so as a core benefit for all staff (86%).

This was also the main method by which respondents offered these benefits in 2016 (87%), although the overall proportion of respondents that include death in service and life assurance in their benefits offering in some way has risen by seven percentage points over the last year.

Life assurance has consistently been one of the top core benefits offered by respondents since the inaugural Benefits research in 2004, topping the list that year as well as in 2007, 2010, 2011 and 2013.

The proportion of respondents offering this benefit has also risen over time. For example, in 2007, 62% offered life assurance as core to all staff and 17% to some staff. By 2013, this had risen so that 76% of all respondents organisations' included life assurance within their core benefits offering for all employees, and 15% did so for some staff.

This year, the proportion of respondents that offer personal insurances remains broadly in line with 2016, the way in which these benefits are being offered has changed.

Over a third (34%) of respondents’ organisations offer travel insurance as an employee benefit. The proportion of respondents offering travel insurance that include it within their voluntary benefits programme has also increased, rising from 22% in 2016 and 37% in 2017. When respondents were asked which benefits they included within their voluntary benefits scheme back in 2011, 12% listed travel insurance, rising to 18% in 2014.

Read the full Employee Benefits/Staffcare Benefits research 2017.