All Group risk articles – Page 16

-

Case Studies

The benefits offered by Sky

PensionTrust-based defined contribution scheme.Double-matched employer contributions to a maximum of 8%.About 4,000 employees were auto-enrolled on 1 April 2013.HealthcareA healthcare trust, available to all staff.Physiotherapy, which is in addition to the trust’s out-patient limit.On-site physiotherapy at some locations.An employee assistance programme.Health screening.Group riskGroup income protection (GIP) linked to the pension ...

-

Article

Article41% would have to rely on savings if on long-term sick leave

More than a third (41%) of respondents would have to rely on their savings if they were forced out of work for any length of time due to illness or injury, according to research by industry body Group Risk Development (Grid).Its Group risk employer research study, which surveyed 1,000 employees ...

-

Article

ArticleBrowne Jacobson adds new perks to flexible benefits

EXCLUSIVE: Browne Jacobson is to add a range of new perks to its flexible benefits scheme, including an online healthy eating programme called Body Chef, and life assurance and critical illness insurance for employees’ partners.It will also increase the limit for staff up to which flex their own life assurance. ...

-

Article

ArticleGroup risk industry paid £1.24bn in claims in 2013

The group risk industry paid out £1.24 billion in 2013, according to research by Group Risk Development (Grid).This is a rise from the £1.2 billion paid out by the industry in 2012, based on statistics from the industry body’s research.The research also broke down the risk benefits paid out by ...

-

Article

Article300,000 more UK workers protected by group risk schemes

The number of employees in the UK protected by group risk insurance grew by 300,000 in 2013, according to Swiss Re.Its Group watch 2014 report, which analysed and summarised group risk business results at the end of 2013, found that the overall UK group risk market grew by 2.8% to ...

-

Article

Article27% know little about group income protection

More than a quarter (27%) of respondents admitted they know little about group income protection, according to research by Canada Life Group Insurance.Its research, which surveyed 200 employee benefits decision makers at organisations that employ between 150 and 2,000 staff, found that 32% of respondents are unaware of the cost ...

-

Article

ArticleArthur J Gallagher acquires The Oval Group

Arthur J Gallagher has acquired The Oval Group for a total net consideration of approximately £199 million.Both Oval Healthcare and Oval Financial Services will now become part of the consultancy’s UK-based Arthur J Gallagher Employee Benefits, led by chief executive officer Tim Johnson (pictured).The acquisition will enable the organisation to ...

-

Analysis

AnalysisHow to align group risk with an employer’s total risk policy

If you read nothing else, read this…Most risk management and insurances are generally handled by risk teams, but people-related products, such as group risk cover, often remain with HR or benefits departments.People-related risk can represent a business risk to the organisation, particularly if the employer’s pay and reward strategy cannot ...

-

Analysis

AnalysisHow to manage workplace dementia

If you read nothing else, read this…Diagnosis rates of people with dementia are increasing.Employers have a duty of care and a legal requirement to make workplace adjustments for staff with dementia. Employee assistance programmes, private medical insurance and group income protection can help to support affected staff.The mental illness hit ...

-

Article

ArticleBuyer's guide to group income protection 2014

The factsWhat is group income protection (GIP)?GIP pays a regular monthly benefit if an employee is unable to work because of long-term illness or injury. Benefits are payable until the employee returns to work or, if earlier, state pension age. Fixed-benefit term policies are also available, typically for periods of ...

-

Article

ArticleAdvisers respond to global benefits trend

Employee benefits advisers are responding to the growing trend among employers, particularly small and medium-sized enterprises (SMEs), of pooling benefits to achieve global cost efficiencies. For example, Willis Group restructured its global benefits in January, combining its existing employee benefits and related consultancy practices. It did this to develop and ...

-

Analysis

AnalysisThe impact of the government's Health and Work Service on group health benefits

If you read nothing else, read this…The Health and Work Service aims to help employees on sickness absence to return to work.The service could help providers and employers to create new wellbeing initiatives.But conflict could arise when an employee goes through the referral process.The service aims to provide occupational health ...

-

Analysis

AnalysisWhat does the future hold for group risk benefits?

If you read nothing else, read this…Life assurance is expected to continue to dominate employers’ group risk focus for the next few years as they auto-enrol their workforces.In a new trend, organisations are separating their pension provision and life assurance cover.An ageing workforce does not necessarily mean higher group risk ...

-

Article

Article63% will not have sufficient pension pot by age 65

Almost two-thirds (63%) of respondents believe they will not have a sufficient pension pot by the age of 65, according to research by Canada Life Group Insurance.Its research, which surveyed more than 700 employees, found that 10% intend to continue working past the traditional retirement age to continue receiving employee ...

-

Analysis

AnalysisBenefits offered to staff based outside the UK

Sample: Respondents responsible for compensation and benefits in their own organisation, which offer benefits to staff based outside the UK (80)Source: The Benefits Research 2013, Employee Benefits, published May 2013.

-

Article

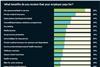

ArticleLife assurance most popular benefit given to HR professionals

This is in addition to salary, bonuses, pensions, share schemes and company cars.The Employee Benefits Salary survey 2014, which questioned 361 people esponsible for managing benefits and reward in UK organisations, found that life assurance is followed by private medical insurance schemes (59%), subscriptions to professional bodies (47%), employee assistance ...

-

Article

Group risk industry paid £1.2bn in claims in 2012

A total of £1.2 billion was paid out by the group risk industry during 2012, according to research by industry body Group Risk Development (Grid).Its research compiled claims statistics to reveal the breakdown of benefits paid out by products, such as group life assurance, group income protection and group critical ...

-

Article

Zurich launches group life assurance for partners

Zurich has launched a group life assurance product for employees’ partners.The product includes:Flexibility for the employer to set the value and number of benefit steps, up to a maximum benefit of £250,000.A simple member acceptance process that operates on a short application form.Cover up to age 75.Nick Homer (pictured), group ...

-

Article

QVC reduces group risk costs by 63%

EXCLUSIVE: QVC has reduced its group income protection (GIP) costs by 63% over the past three years.The home shopping channel, which has 2,000 employees, had historically provided full-term GIP for the 600 members of its defined contribution (DC) pension scheme.It consulted with Towers Watson’s healthcare and risk consulting practice to ...

-

Article

Friends Life simplifies death-in-service claims process

Friends Life has simplified its death in service claims process by removing the need for claimants to show an original death certificate.The service, which provides financial support if an employee dies, will now verify the death in service instantly through the government records office.The online tool allows claims to be ...