All articles by Clare Bettelley – Page 15

-

Analysis

AnalysisReward's role in building trust

If you read nothing else, read this…Organisational trust is based on co-operation, co-ordination and collaboration.Employers should be realistic to staff about their employment proposition.Robust service level agreements are not the only way employers can build trust-based relationships with providers.A desire to rebuild employee and investor trust was clearly at the ...

-

Article

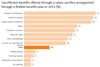

ArticleBuyer's guide to salary sacrifice car schemes

The factsWhat is a salary sacrifice car scheme?This is a car scheme for which an employee forgoes a portion of their gross salary in exchange for a car, and receives tax and national insurance breaks.Where can employers get more information?www.employeebenefits.co.uk/benefits/company-cars-and-fleetwww.hmrc.gov.ukWho are the main providers?ALD Automotive, Alphabet, Fleet Evolution, Fleet Hire, ...

-

Article

ArticleGroup personal pensions most popular among employers

Almost half of the respondents (48%) to the Employee Benefits/Capita Pensions Research 2013 still offer a group personal pension (GPP) as their primary pension plan.This is in line with Employee Benefits’ 2011 pensions research, in which 54% of respondents said a GPP was their primary plan choice. Similarly, GPPs were ...

-

Article

Article84% of DC pensions have a default option

The vast majority (84%) of respondents with a defined contribution (DC) pension scheme offer their workforce a default investment option, according to Employee Benefits/Capita Pensions Research 2013.The research, conducted among 370 HR and benefits managers, found that just 16% of respondents that offer a DC plan do not.A default investment ...

-

Article

Article57% pass on responsibility for default funds

Over half of respondents (57%) hand over responsibility for their default fund to their pension provider or financial adviser, according to the Employee Benefits/Capita Pensions Research 2013.The survey, conducted among 370 HR and benefits managers, found that 29% rely on their adviser and 28% put their trust in their pensions ...

-

Article

Article47% of employers review default fund annually

Just over half (47%) of respondents review the investment strategies and aims of their default investment fund at least annually, according to Employee Benefits/Capita Pensions research 2013. (This does not include respondents that do not review their own strategies, or those that do not know).The survey, conducted among 370 HR ...

-

Article

Article36% of employers use provider's default fund

More than a third of respondents (36%) use the default investment option offered by their pension provider, according to Employee Benefits/Capita Pensions Research 2013.The survey, conducted among 370 HR and benefits managers, found that 31% entrust the selection of investment funds in their default offering to their adviser, while 27% ...

-

Article

Employee Benefits/Capita Pensions Research 2013

Read digital version of Employee Benefits/Capita Pensions Research 2013.It reveals:scheme type - the schemes proving most popular with employers and contribution rates being adopted for auto-enrolment;communication - how employers are communicating their pension schemes and why;default investments - employers’ default options and employee take-up;auto-enrolment - top tips from employers that ...

-

Article

Employee Benefits Awards 2013: Best flexible benefits plan - large employer

Winner: Severn Trent WaterScheme: LifestyleEntered by: EdenredThe judges were looking for an employer with more than 1,000 employees that has made delivering benefits through a flexible benefits plan effective. This is a plan that operates with a set enrolment period in which employees select benefits for a defined period.The judges ...

-

Article

Group risk report 2013

PDF version of Group risk report 2013Ot read the articles online:David Williams: The future of group risk benefits looks flexibleGroup risk facts and figuresHow to align group risk benefits with business strategyKatharine Moxham: New opportunities in the group risk marketTop tips for minimising group risk benefits spendHow to use group ...

-

Analysis

AnalysisHow employers should manage workplace stress

IF YOU READ NOTHING ELSE, READ THIS…Employers should play a proactive role in managing stress in the workplace.Line managers can play an important part in stress management, but they must be given suitable training.Employers should encourage staff to take responsibility for their own physical and mental wellbeing.There are countless legal ...

-

Article

Pensions report 2013

Click to to read digital version of Pensions Report 2013Or read articles online:Graeme Bold: Top tips to help employers prepare for auto-enrolmentThe pros and cons of using multiple pension plans for auto-enrolmentTop five considerations for at-retirement strategiesRichard Shelton: Codes of conduct on retirement planningSchlumberger educates expat staff about pensions valueVolkswagen ...

-

Article

Healthcare research 2013

Employee Benefits’ Healthcare Research 2013 reports on employers’ current healthcare issues and attitudes to, for example, what they believe their healthcare benefits are achieving for their workforce.The research also covers: The actions employers are likely to take around healthcare provision in the next 12 months; How the economic climate has ...

-

Case Studies

Henderson Global Investors sees high take-up in share schemes

Henderson operates a variation of plans across 20 countries, including: a UK and a US sharesave; a UK and an international Sip; an employee stock ownership plan; and a restricted share plan, which was launched in 2004 for senior employees and has performance conditions attached to it.Henderson offers employees in ...

-

Analysis

AnalysisWhy share schemes remain a valuable employee benefit

IF YOU READ NOTHING ELSE, READ THIS…Hundreds of thousands of employees continue to save through share plans despite the economic downturn.YouTube videos are a new way for employers to engage employees with their share plans.Employers need to help employees to think like shareholders.The possible windfall awaiting savers on maturity of ...

-

Case Studies

Volkswagen UK educates staff about retirement options

Platten says: “I talk about their aspirations, what they want to achieve and their options at retirement, and try to make them feel as comfortable as possible.”Volkswagen also holds retirement planning seminars for staff who are retiring. The one-day seminars are hosted by Platten, who invites a range of industry ...

-

Case Studies

Listening approach keeps Network Rail’s reward and benefits package on track

“I was very conscious of sitting and listening to people and asking lots of questions,” she says. “It was an opportunity to ask the dumb questions because I was the new girl, so I took advantage of that. I asked the questions that perhaps [new recruits] can’t ask two or ...

-

Analysis

AnalysisHow to manage legacy employee benefits strategies

IF YOU READ NOTHING ELSE, READ THIS…New recruits must resist the temptation to start their new role with an overhaul of their predecessor’s strategies.Some organisations may simply require an HR professional to maintain current standards.Speaking the same, finance-based language as their new executive board is a key skill for all ...

-

Analysis

AnalysisTop five considerations for at-retirement strategies

IF YOU READ NOTHING ELSE, READ THIS…Trustees and pension providers must support employees when they are making their at-retirement choices.Online modelling tools can help crystallise employees’ at-retirement income.The open market option for annuities should be factored into at-retirement communications strategies.1. Regulatory requirementsThe Pensions Regulator (TPR) believes that defined contribution (DC) ...

-

Case Studies

Schlumberger educates expat staff about pensions value

Oilfield services business Schlumberger has introduced a classroom-based training course and pension modelling tools as part of an initiative to help engage its expatriate employees with its defined benefit (DB) pension plan.Sarah Moise, global benefits manager at Schlumberger, says: “Although we hire from universities, retirement is typically not our recruits’ ...