All Article articles – Page 704

-

Article

NAPF calls for more support for prospective retirees

Prospective employees are not getting enough support with choosing an annuity, according to the National Association of Pension Funds (NAPF).The Supporting savers at retirment report, which looked into employer advice and the brokerage market used by employers in the private sector with staff in defined contribution (DC)pension schemes, highlighted a ...

-

Article

Buy-out completed on Imperial Home Decor DC pension

Imperial Home Decor has completed an enhanced buy-out of the defined contribution (DC) section of its pension scheme.The scheme has been in wind up since October 2003 when the organisation was declared insolvent.The deal that has been secured will see almost 140 DC members benefit from an enhanced annuity deal ...

-

Article

Shepherd Neame to bring forward auto-enrolment staging date

EXCLUSIVE: Shepherd Neame is to bring its staging date forward by three months and amend its trust-based defined contribution (DC) pension scheme to comply with its auto-enrolment duties.The brewer, which is working with BBS Consultants and Actuaries, elected to bring its staging date forward to 1 July from 1 September ...

-

Article

Standard Life and Punter Southall launch auto-enrolment product for SMEs

Standard Life and Punter Southall Defined Contribution Consulting (PSDCC) have teamed up to provide an auto-enrolment product for small and medium-sized enterprises (SMEs).The agreement allows PSDCC to offer SMEs Standard Life’s Group Flexible Retirement plans as an off-the-shelf auto-enrolment product.Employers will receive:Access to Standard Life’s auto-enrolment tools.Access to online resources ...

-

Article

Opt out rules upset Barbon's auto-enrolment plan

EXCLUSIVE: Barbon Insurance will postpone the date on which it automatically enrols staff into its pension scheme in order to comply with the Pensions Act 2008 on opting out.The employer’s staging date is 1 November 2013 and it was hoping to use its benefits window between August to September in ...

-

Article

GeoPost UK prepares for auto-enrolment

EXCLUSIVE: GeoPost UK is encouraging employees to join its group personal pension (GPP) ahead of its auto-enrolment staging date of 1 August 2013.Under the banner ‘Last Chance Saloon’, the logistics organisation invited all employees who were not members of the pension scheme to join the GPP, which matches employee contributions ...

-

Article

MPs call for mandatory equal pay audits

Equal pay audits should be mandatory for large private sector employers, according to a report by the Business, Innovation and Skills Committee.Its Women in the workplace report also stated that the Equality and Humans Rights Commission (EHRC) should publish details of organisations that are not compliant.The Government Equalities Office published ...

-

Article

High level of understanding around retirement options

Almost three-quarters (73%) of pre-retirees and 89% of annuity purchasers are comfortable with the level of understanding of their retirement options, according to research by the Association of British Insurers (ABI).Its research, Retirement choices: baseline to measure effectiveness of the code of conduct, included 500 pre-retirement telephone interviews with members ...

-

Article

Lafarge appoints fiduciary manager for DB pension

Lafarge has appointed Towers Watson as fiduciary manager for the investment requirements of its £2.6 billion defined benefit (DB) pension scheme.The appointment follows a formal selection process undertaken by the trustees of the scheme and with advice from KPMG and Sackers.KPMG’s remit was to advise Lafarge on the various approaches ...

-

Article

Lincoln Uni educates staff on personal allowance

EXCLUSIVE: The University of Lincoln is piloting financial education sessions for its senior management to ensure they are informed about their options around the annual and lifetime allowances for pensions saving.The sessions, which are part of the university’s financial education programme with Wealth at Work, started with a session for ...

-

Article

SAP to outsource benefits system ahead of auto-enrolment

EXCLUSIVE: SAP is to outsource its employee benefits system to enable it to cope with its pensions auto-enrolment duties.The technology organisation, which will reach its staging date in September 2013, made the decison to switch from an in-house benefits system to one provided by Capita Employee Benefits, following its annual ...

-

Article

HMRC announced new company car advisory fuel rates

HM Revenue and Customs has announced a change to its company car advisory fuel rates. The change relates to some petrol and diesel cars.The rates for all vehicles from 1 June 2013 are as follows:Petrol1400 cc or less to pay 15p per litre.1401 cc to 2000 cc to pay 17p ...

-

Article

ArticleBenefits failing to adapt to changing workforce demographic

Employee benefits have failed to adapt to the changing workforce, leaving UK workers financially exposed, according to research by Cass Business School and commissioned by Unum.The Keeping pace? Financial insecurity in the modern workforce report found that the modern workplace has 13% more female employees, 46% more older employees and ...

-

Article

Fit notes have positive impact on absence

The fit-note system is having a positive effect on reducing long-term sickness absence, according to research by the Institute for Employment Studies (IES) and the University of Liverpool.The study, which collected data from 58,700 fit notes distributed to 25,000 patients between October 2011 and January 2013, was conducted by the ...

-

Article

Pension members inactive about investment management

One in five (21%) respondents take an active role in managing their pension investments, according to research by Capita Employee Benefits. The research, conducted among 3,000 employees, also found that 27% of respondents have opted for the default funds provided by their employer.The research also found:52% of respondents do not ...

-

Article

Unaffordable retirement will impact firms' ability to recruit staff

According research by Hymans Robertson two-thirds of respondents to believe that almost half their workforce will be unable to retire at the state pension age due to inadequate pension savings.Its research, conducted among 200 HR directors and managers, found that 78% of respondents have considered the impact this would have ...

-

Article

E.On raises pensions take up to 92% after auto-enrolment

EXCLUSIVE: E.On has increased the take up of its group personal pension (GPP) plan to 92% after a year of communicating auto-enrolment.The auto-enrolment process began for the utility business about 18 months ago, when it looked at the options it had around complying with the legislation.The utilities business decided to ...

-

Article

Liability-driven pension investment increases to £446bn

Liability-driven pension investment (LDI) increased by 11% in 2012, according to research by KPMG Investment Advisory.The KPMG 2013 LDI survey, which questioned 30 institutional managers, found that LDI now covers £446 billion of pension liabilities, with 686 UK pension scheme mandates now employing LDI.However, the provision of LDI remains dominated ...

-

Article

Tribunal says employers could set retirement age

The Employment Tribunal (ET) has judged that compulsory retirement might still be justified in some circumstances.On 30 May the ET ruled on the Leslie Seldon case which was brought because Seldon was required to retire at age 65 from the partnership of the law firm Clarkson Wright and James.At the ...

-

Article

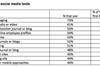

ArticleSocial media tools not seen as cost effective

More than half (56%) of respondents currently use social media tools as part of their communication with employees, according to research by Towers Watson.The 2013 Towers Watson Change and communication ROI survey, which polled 290 large and medium-sized organisations in Asia, Europe and North America, found, however, that only between ...