The number of women preparing adequately for retirement is at an all-time low and remains well behind the preparation levels of their male counterparts, according to research by Scottish Widows.

The ninth annual Scottish Widows 2013 Women and pensions report, which surveyed 5,000 people, found that just 40% of women, compared to 49% of men, are prepared adequately for later life, a drop from 42% in 2012 and 50% in 2011.

The research found that more than a third (37%) of women have no pension, while the same applies for more than a quarter (27%) of men.

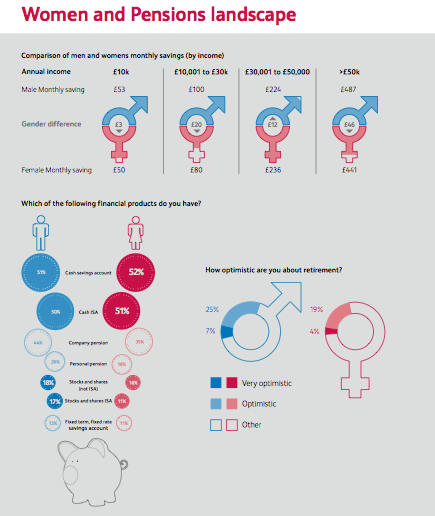

Female respondents who are saving are putting aside £182 a month on average, well below the average amount of £260 among male respondents. This creates a gender pension savings gap of nearly £1,000 a year.

The research found that different lifestyle factors are impacting the savings habits of women at different ages. For instance, women in their 20s were found to be tied down by short-term financial pressures and are prioritising living expenses (42%), paying off debts (26%), travel and holidays (23%) or saving for a property (18%) above saving for retirement.

More than half (54%) of those aged between 22 and 29 do not have a pension, compared to 37% of the general female population.

Only 50% of women in their 30s work full-time compared with 81% of men of the same age, which means 30-something women bring in an average gross income of £19,200, way behind the £28,700 of the average 30-something man. Career breaks and cutting back on hours have a knock-on effect on women’s ability to save, with women in their 30s only saving £87 a month on average towards retirement, outside of pension and property investments. This is compared with the £151 that their male counterparts are saving each month outside of pensions and property.

By the time women reach their 40s, their financial priorities have changed, with almost a quarter (23%) of those aged between 40 and 49 prioritising financially supporting their children over retirement saving in the last five years. Nearly one in four (24%) also said they expect their partner’s income to help support them in retirement, despite the fact that 79% do not know what their partner would be entitled to from their pension fund if they were to separate.

Despite their proximity to retirement age, paying off debt is still a priority for women in their 50s, with 24% of women of this age still considering paying off debt a bigger priority than saving for retirement. Women in their 50s still owe an average amount of £11,400, slightly higher than the £11,000 of average debt among women in their 40s.

Lynn Graves, head of business development, corporate pensions at Scottish Widows, said: “It is worrying to see that women are continuing to lag behind men in retirement savings. The number of women preparing adequately for retirement has dropped from last year to a record low.

“This growing gender gap in retirement savings means that women are facing an ever increasing shortfall when it comes to retiring and must act now to ensure they will not be left exposed in later life.

“We have identified the different barriers that prevent women from saving at every life stage, helping us to see where this gender savings gap is coming from and understand how best we can support women to help them overcome these barriers.

“The pensions industry, government and employers need to work together to raise awareness of the unique lifestyle pressures that take their toll on women’s savings at different ages and help women prioritise their pensions.”