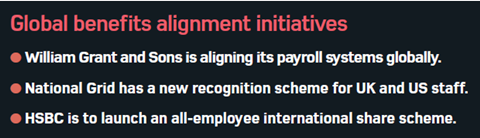

Distillery William Grant and Sons is in the process of aligning its payroll systems across Australia, Asia and Europe. National Grid has launched an international recognition scheme for its 15,000 UK and US employees. And HSBC will introduce a new all-employee international share scheme later this year.

While some benefits lend themselves to global alignment, difficulties can arise for employers in the delivery of these benefits. Tim Reay, main committee member and former chairman of the International Employee Benefits Association, said: “The important thing is to distinguish design from delivery. Employers can align benefits design a lot more easily than they can align delivery.”

Justin Crossland, senior consultant in Towers Watson’s international consulting group, added: “Where I’m helping organisations with global health and wellbeing strategies, there is certainly a desire to align strategy and target specific outcomes.

“That might be in wanting to provide appropriate access to healthcare globally. It might look very different in the UK than it would in parts of Europe or Asia, but it is a theme of being able to provide adequate access to some form of healthcare.”

Healthcare and group risk benefits are more commonly aligned globally. Reay added: “We are seeing organisations starting to align [group risk] purely because they are easily defined, they are not tremendously expensive benefits and they have high visibility.”

Crossland said: “There are certain benefits or programmes that are better suited [to go global], such as an employee assistance programme or a health risk assessment programme.

“One of the reasons organisations are doing this is to have a better understanding of the data, to be able to measure outcomes, to understand what the programmes are doing. That applies across a number of benefits programmes.

“Even if you are talking about more traditional benefits, what they are trying to do is align the data and management information from benefits programmes so they can readily assess that.”