Let’s start with an uncomfortable reality.

Most organisations are paying more each year for dental benefits that deliver less impact for employees and less value for the business. This isn’t because Reward teams have made poor decisions. It’s because the problem dental benefits were built to solve has changed.

Employees are navigating a dental system that is fundamentally constrained by access, not awareness or willingness to engage.

Employees are navigating a broken dental landscape

The majority of working adults still rely on the NHS for routine dental care. That system is overburdened, capacity constrained and increasingly inaccessible. For millions, routine appointments are unavailable or delayed indefinitely.

Preventative care is postponed. Minor issues are ignored. Employees only seek help once pain or infection forces action, often at the worst possible moment and during working hours.

Private dental insurance has not closed this gap. Premiums continue to rise, driven by higher utilisation, increased treatment complexity and inflationary pressures. Employers are pushed into a cycle where spend increases without a corresponding improvement in access or outcomes.

Cash plans and Insurances, while well intentioned, struggle for relevance. Reimbursement-based models do little at the moment an employee actually needs care. Utilisation remains low, engagement is weak and the operational impact is minimal.

Different models, same outcome: employees still struggle to get help when it matters.

The common problem is access, not cost

Rising cost is what shows up in budgets. Access failure is what causes it.

Dental issues rarely emerge overnight. They develop slowly, often without symptoms, until they become painful, urgent and expensive. When employees cannot access early advice or intervention, preventative opportunities are lost and escalation becomes inevitable.

Absence follows. Emergency appointments replace routine care. Costs rise sharply and unpredictably.

Access is not a “nice to have”. It is the primary lever for cost control.

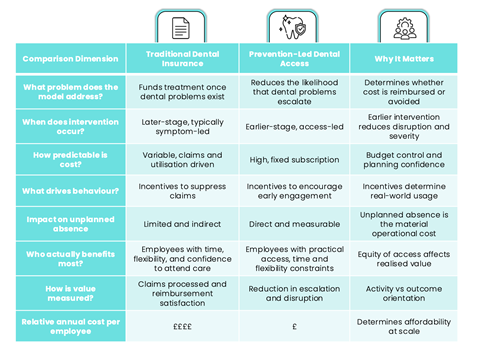

Dental ‘cover’ versus dental ‘care’

This distinction sits at the heart of the issue.

Most organisations currently offer dental cover. Cover is designed to manage cost after a problem has already occurred. It reimburses treatment, usually weeks later, and only if the employee has been able to attend an appointment.

That model assumes three things:

- employees can fund treatment upfront

- employees can attend appointments during working hours

- absence is an acceptable price of accessing value

In reality, these assumptions exclude large parts of the workforce and hard-code disruption into the benefit itself.

Dental care works differently. It is access-led and prevention-first. Instead of waiting for a claim, care supports employees earlier, whether they are symptom-free, experiencing early discomfort or simply unsure whether something needs attention.

Access enables prevention. Prevention reduces escalation. Escalation is what drives cost and absence.

Dentistry has lagged behind healthcare innovation

Other areas of employee healthcare have already adapted. Virtual GPs, mental health support and digital triage are now mainstream.

Dentistry has historically been treated as inherently physical. But technology has changed what’s possible. Digital consultations, image sharing and clinical triage now allow a significant proportion of dental issues to be resolved, stabilised or managed without immediate in-person treatment.

This doesn’t eliminate the need for physical dentistry. It makes it more targeted, timely and effective.

Crucially, it gives employees somewhere to turn before problems become emergencies.

The opportunity is a hybrid approach

The goal is not to remove insurance. It is to make it work smarter.

A modern dental strategy uses access-led, tech-enabled care as the first line of support, with insurance sitting behind it when physical treatment is genuinely required.

This hybrid model changes the economics:

- employees get faster access and clearer guidance

- early issues are resolved before they escalate

- claims pressure reduce

- absence becomes the exception, not the mechanism

What looks like a benefit decision becomes an operational one.

From benefit line item to business strategy

The shift from dental cover to dental care is not ideological. It’s practical.

When access is prioritised, organisations move from funding dental problems to preventing them. That delivers better outcomes for employees and more predictable costs for employers.

The question for 2026 is no longer whether you offer dental benefits. It’s whether those benefits are designed for the environment your workforce actually operates in.