Employee benefits have failed to adapt to the changing workforce, leaving UK workers financially exposed, according to research by Cass Business School and commissioned by Unum.

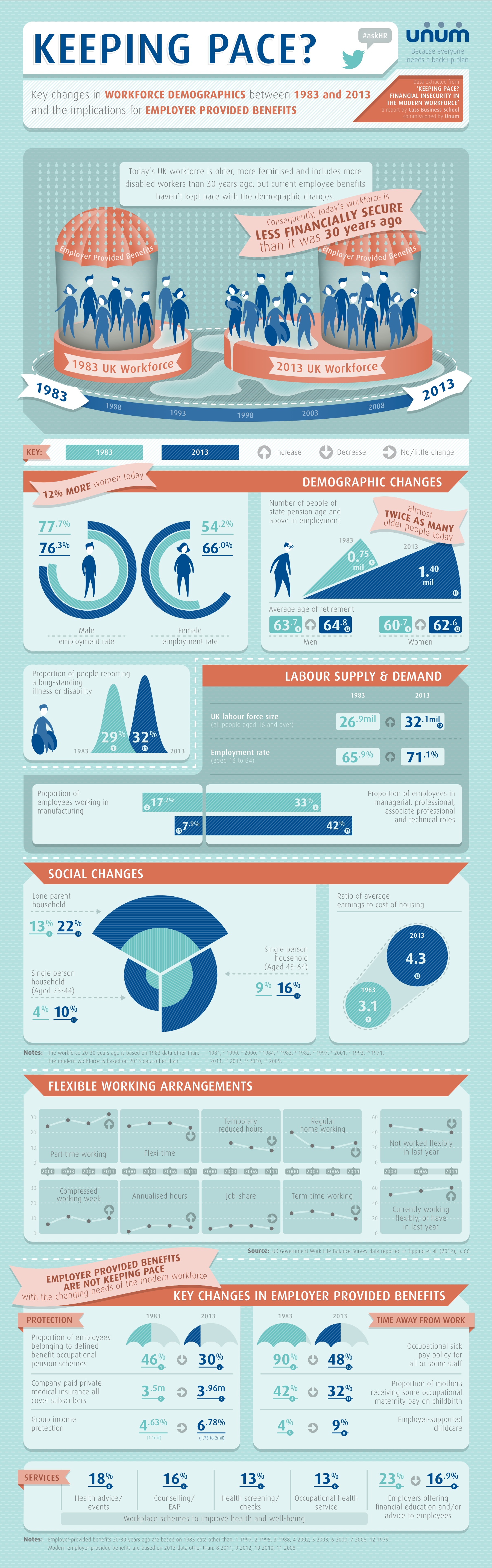

The Keeping pace? Financial insecurity in the modern workforce report found that the modern workplace has 13% more female employees, 46% more older employees and 11% more employees who are ill or disabled, compared to the 1980s.

Despite this changing demographic, the report said, employee benefits provision, including pension schemes and income protection, have not kept pace with the change, resulting in a workforce that is less financially secure now than they were 30 years ago.

The report identifies three groups that are most at risk: people with disabilities or long-term illnesses, older workers and employees with caring responsibilities. It finds that women are more likely to fall into one of the at-risk categories, meaning that they are disproportionately impacted by the employee benefits gap.

For employees with disabilities or long-term illnesses, the report recommends that employers:

- Provide specialist vocational support to help employees return to work.

- Offer income protection to increase financial security when employees are long-term sick, and allow employees to maintain their standard of living while unable to work.

- Make workplace adaptations to both help people remain in employment, and to help people back to work.

For older employees and carers, the report recommends that employers:

- Partner with insurers to develop and offer group social care protection to help employees meet the first £75,000 of care costs.

- Contribute a higher proportion of salaries to workplace pension schemes.

- Extend flexible working rights to older people and those with caring responsibilities, to allow them to remain in work.

- Provide elective medical insurance, to speed up recovery for this group, as illness can prevent people from carrying out caring responsibilities, impacting on dependents.

For female employees, the report recommends that employers:

- Provide higher contributions to women, to address gender inequalities caused by career breaks to have children and the increased likelihood of flexible working.

Nick Bacon (pictured), professor at Cass Business School, part of City University London, said: “Financial insecurity has been compounded by an increased cost of living and higher levels of unemployment, meaning that employees are more likely to fall into financial difficulty than they were 30 years ago.

“During the same period, employee benefits have declined, leaving a gaping hole in the financial protection of today’s employees.

“Financial insecurity has a negative impact on employee health and wellbeing, and also productivity. Employers that provide benefits designed to support the financial security of their staff, such as access to vocational rehabilitation, typically see a more productive workforce.”

Linda Smith, HR director at Unum UK, added: “More than ever, people are looking to their employers to provide the financial protection they need.

“A better protected workforce is good for the employer, as well as the employee.

“From our experience, we know that employees with the rehabilitation support that comes with income protection find it easier to transition back to work, should they leave the workforce.”

A terrific article on a weighty piece of research. We’re all getting older and many of us are fully paid-up members of the sandwich generation, maintaining older relatives heads above water whilst supporting our kids with their efforts to break into the jobs market. And in that sense, the right employee benefits have a vital role to play. Right for employers in terms of return on investment and relevance to the entire workforce rather than just the highest earners and best performers. Right for employees in terms of what’s appropriate and relevant for their life-stage. Most importantly, for employers and employees, it’s about being able to trust the financial services industry to deliver on pensions and protection when the time comes. The huge question-mark on that following the global financial crisis underpins the cause and effect of why pensions and protection have failed to keep up, rather than general benefits provision per se.

With the average pension pot on retirement amounting to £25,000 and delivering an income of £1200-£1400 p.a. and financial protection premium inflation soaring, it’s no wonder that employers have looked at cheaper, more flexible and more immediate alternatives. And in that sense, the voluntary benefits (VB) sector of the benefits industry is thriving because a capable VB provider can deliver savings on everyday expenditure between £500-£1000 per annum for employees, and increasingly pensioners where employers are far-sighted enough to make provision. That can be an enormous help to older workers trying to combat the ravages of higher costs of living with under-funded pensions and gives younger ones the option of starting provision if they want to, with their savings.

In conclusion, when looking at the pace of change in benefits, employers are increasingly backing the VB hare rather than the financial protection tortoise.