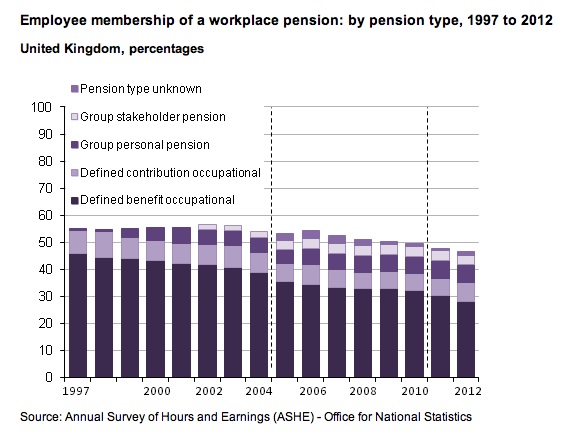

The proportion of UK employees who are active members of a workplace pension scheme has plummeted to a record low of 46%.

This is the lowest level since records began in 1997, according to research by the Office for National Statistics (ONS).

The ONS’s Annual survey of hours and earnings research also reveals that active membership of defined benefit (DB) pension schemes fell from 46% in 1997 to 28% in 2012.

The research also found:

- There were 8.2 million active members of occupational pension schemes in 2011, the lowest recorded level since the 1950s.

- Although membership in the private and public sectors has fluctuated over the period, private sector membership had fallen to 2.9 million in 2011, while public sector membership had been fairly stable for a number of years at just over five million.

Stephen Lowe, director at retirement income specialist Just Retirement, said: “These figures show us that people are still contributing far too little of their salary to pension savings, and often we are seeing that those who do save are not getting the best deal when it comes to turning savings into income.

“Government schemes like auto-enrolment should help improve savings, and the [Association of British Insurers’] mandatory code of conduct on retirement choices goes some way to ensuring the insurance industry does its part, but people will benefit from professional financial advice that considers how best to organise and decumulate pension and housing assets to meet the challenges faced in later life.”

Joanne Segars, chief executive at the National Association of Pension Funds, added: “These bleak figures show that pension uptake is shriveling at a seemingly unstoppable rate. Without auto-enrolment the UK would be well on course for a crisis in paying for its old age.

“The recent lack of appetite for a pension among private sector workers is particularly worrying. The patchy economy, weak annuity rates, and mistrust of the pensions industry’s fees and charges are all to blame.

“The future looks more promising. The early signs are that auto-enrolment is going down well with staff, and the vast majority are sticking with their new pension. These much-needed reforms will bring millions more into a pension over the coming years, particularly from smaller employers in the private sector.

“Pension schemes have worked hard to make auto-enrolment a success. But there is no room for complacency. The government, the industry, and employers must do their utmost to explain the benefits of a pension to people, and to lift confidence in the system.”