When employers decide to set up or renew a fleet, there can be many funding options to consider.

If you read nothing else, read this…

- Funding a fleet is a complex task and it is worth employers seeking impartial expert advice.

- There is no best method for funding a fleet; it depends on the employer’s financial situation.

- Employers should look at funding holistically: how much will fuel and maintenance cost?

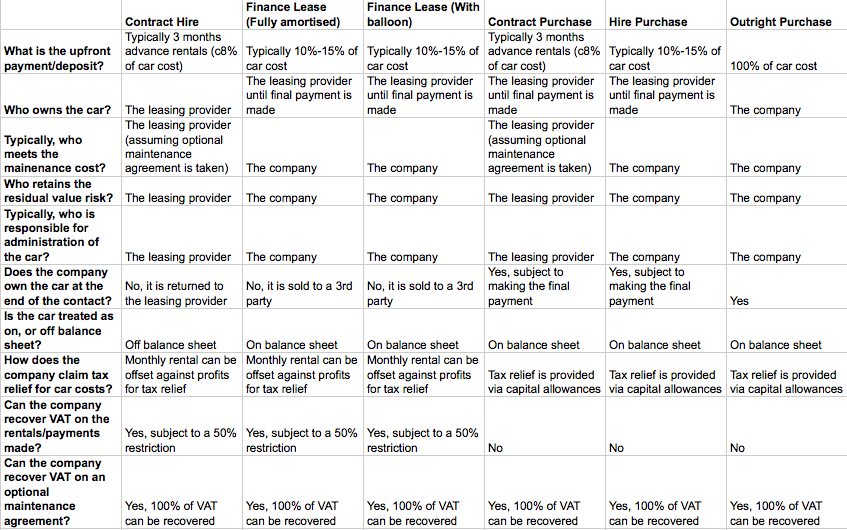

The questions and options are almost endless. Should the employer use a finance lease, contract purchase, hire purchase or should they buy the cars outright?

Funding a fleet is certainly a stressful task, but Martin Franks, business development manager at Motiva, says there are three important introductory phases an employer can go through.

“One of the key decisions employers need to make is to assess their appetite to risk,” says Franks. “As an example, if an employer bought its fleet outright, there is a risk in three years’ time that it may not hold a reasonable residual value. However, the reward is that if it’s doing well in the marketplace, [the employer] will make more money when it’s sold on.”

On or off balance sheet

Another consideration is whether employers want their fleet funding to be shown as an asset on or off their balance sheet, says Franks. “The choice is about the gearing [a ratio of debt finance as a proportion of total outstanding finance] of the organisation from a profitability perspective.”

An employer should also consider what experience it has of managing a fleet. Franks says employers need to have the experience to buy a fleet, as well as to maintain the cars throughout their lifecycle, including administration costs.

But is there one funding method that is better than any other? Cliff Ainger, a fleet manager at ARI UK, does not think so. “It depends on the organisation’s financial situation as to which method suits it best,” he says. “It is important that any organisation considering changes to its policy on [car] acquisition methods seeks expert, impartial advice.”

Outright purchase

Alison Argall, a business development director at Tusker, says employers typically recycle their fleets every three to four years, but small and medium-sized enterprises (SMEs) are keeping outright purchase cars longer than that.

“[The length of car service is] moving up to five years,” she says. “But it’s a false economy because [employers] will be spending more on maintenance than they will on the cost of the depreciation.”

Contract hire

Contract hire or contract hire purchase funding would give SMEs the efficiencies of outsourcing, with an provider running the fleet and managing all the associated costs, which gives employers good visibility of their car-related expenses, says Argall.

Dan Rees, a senior manager at Deloitte Car Consulting, adds: “Traditionally, cars were purchased outright a couple of decades ago, but contract hire is now a very popular method. That’s because fleet providers also provide the management of the cars and so the role of the fleet manager has eroded over time, cutting down organisations’ management expenditure.”

However, for employers that can afford it, it is helpful to have at least one fleet manager to serve as a point of contact for a provider and to co-ordinate the scheme, says Rees.

Whole life costs

Employers can get a more accurate picture of a how much a car will cost by considering its lifetime costs (commonly known as whole life costs). This takes into account a number of factors, including depreciation (the difference between the purchase price and residual value of the car at the end of the lease contract), maintenance and servicing costs, fuel consumption, taxation, vehicle excise duty, and employers’ Class 1A national insurance contributions, which are based on a manufacturer’s recommended retail price.

Employers should, therefore, always consider long-term costs when assessing fleet funding options.

Fleet funding options: All the details

My name is farouk responsible for GETRAK operations

http://www.getrak.com/pt/

About GETRAK: GETRAK provide solution to a variety of companies that needs

tracking or M2M software from all parts of the world.

Our proposal is help companies expand into new markets with new

innovative technology or increase market share by developing strategic

partnerships with industry innovators.

We would also be interested in determining if your company may have an

interest in working with us.

GETRAK supplies complete and innovative software solutions for more than

250 tracking companies. Our target is create important technological

differentials, giving support to our partners growth.

If you need any additional information, please do not hesitate to contact

me. We can further expand on what we are looking for and how your

technology might help. If you could give us more information about your

business, we can study a collaboration strategy.

I really liked your blog.Really thank you! Really Cool.