EXCLUSIVE: April 2016’s reductions to the annual and lifetime pensions allowances impacted between 1% and 5% of staff in just under half (45%) of employer respondents’ organisations, according to research by Employee Benefits and Close Brothers.

The Employee Benefits/Close Brothers Pensions research 2016, which surveyed 250 employer respondents, also found that a further 12% said between 6-10% of staff were affected, while 10% of respondents said that none of their employees were impacted by the change.

This contrasts somewhat to the results of last year’s research, which found that 14% of respondents felt a significant number of staff would be affected by the allowance reductions.

From 6 April this year, the annual allowance for those earning more than £150,000 a year was tapered down to a minimum of £10,000, while the lifetime allowance for pension contributions was reduced from £1.25 million to £1 million.

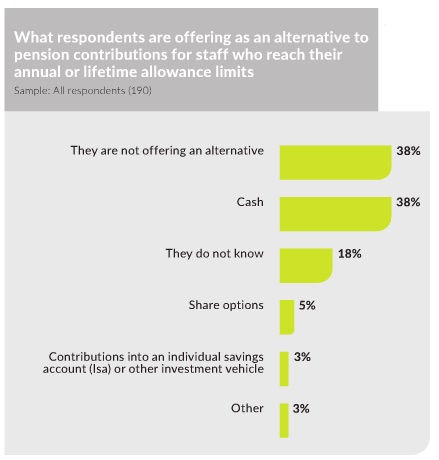

While some organisations have looked to alternative forms of remuneration to compensate affected staff in lieu of pension contributions going forward, a higher percentage of respondents than last year have decided not to do so. Last year, 27% of respondents indicated that they were not planning to introduce any alternative form of remuneration for affected staff. This year, 38% of respondents said that, after the event, they have not done so.

Where respondents do offer alternative forms of reward to affected staff, cash remains the most popular option.

Watch Employee Benefits Wired: Maximising pensions potential. The 30-minute panel discussion can be viewed online anytime on EB TV.