As the festive season approaches, discounts offered through voluntary benefits can raise employees’ spirits while keeping costs down

If you read nothing else, read this…

- Staff who are cash-strapped in the run-up to Christmas will appreciate access to discounts and cashback on products.

- How voluntary benefi ts are provided is as important as what is offered.

- Not all discounts and vouchers are appropriate to all employees, as Christmas-focused benefits.

With the UK still in the grip of recession and Christmas only weeks away, employers that want to offer employee benefits to reflect the festive spirit are under greater financial pressure than ever to do more with less.

Managing cost is only part of the challenge. The perks must be appropriate for staff who are also feeling the pinch and are under pressure to economise at Christmas.

So it is no surprise that more employers are focusing on the discounts and savings available through voluntary benefits schemes.

Essentially, these are discounts arranged by employer for goods or services provided by third parties, typically a percentage reduction in high-street stores, or a range of offers from other relevant service providers.

Mike Morgan, managing director of PeopleValue, which has seen a huge increase in retail trade through its discount portal Advantage, says: “Voluntary benefits are more important now than ever. We have seen sales of vouchers and credit on retail cards almost double from the same period last year, a trend we expect to grow in the run-up to Christmas.”

Advantage works by assigning employees an account and crediting these under a cashback arrangement when they make a purchase, rather than discounting the face value of the voucher or card.

“The big increases in spend are around more of the day-to-day expenditure, with groceries being the most popular for cashback,” says Morgan. “From an average shop of just £100 a week, employees can save over £240 [a year] just on groceries.”

One of the big attractions of staff discounts is that they enable employers to offer a benefit that is relevant to everyone in their workforce.

Alex Bailey, marketing manager at Asperity Employee Benefits, says: “This is especially important at Christmas, when employers want to benefit everyone without breaking the bank.Discounts are the simplest and most cost effective route to employee engagement. Saving money is of interest to everyone, particularly in the current climate, so much so that bargain hunting has become integrated into the nation’s culture. The other employee benefit that should be on the list at this time of year, of course, is a brilliant Christmas party.”

Gift cards a seasonal favourite

Gift cards, which can be given as presents or used to take advantage of the discounts built into them, are always a seasonal favourite with employees, especially in an economic downturn, says Susanne Laursen Busch, chief strategy officer at Logbuy, which is launching a range of e-cards and e-vouchers for the rapidly growing mobile market.

“They appeal to employees of all ages, lifestyles and levels of employment,” she says.

“We have the technology to personalise these benefits using the same demographic criteria, and target relevant benefits within specific geographical areas, ensuring that the offering is both broad-ranging in terms of choice, and tailored to the individual.”

So if money-saving offers are the must-have benefits as Christmas approaches, are there any perks that it might be better to leave out of a benefits package?

Asperity’s Bailey says: “Childcare vouchers, perhaps, because they are only relevant to parents, and possibly health benefits or pensions, because they can prove difficult to engage staff with, even at the best of times.”

Oliver Bence, principal consultant at Benefex, says employers might want to steer clear of a specific retail voucher as a standalone benefit, unless it is really relevant to an employee. “It is just not worth the effort when most retailers take part in some sort of wider retail voucher or card scheme. Take-up tends to be very poor and not worth the time and effort. It is far better to leave an individual retail voucher as part of a wider scheme.”

Some benefits may seem to have seasonal appeal, but their suitability needs careful consideration, says Michael Rose, managing director of Rewards Consulting.

“If employers are thinking of offering discounted membership of a wine club, for example, think about the organisation and the workforce, and whether such a benefit is appropriate to the culture,” he says. “And be mindful of sending mixed messages. If employers have spent the year promoting and offering employee health and wellbeing programmes, they have to question the wisdom of offering alcohol.”

Mobile phones and computers

Then there are benefits that can be valuable but must be treated with care. Bence says: “Mobile phones and computers need careful thought because of the administration side, particularly at the end of the scheme when it comes to returning them or the employee paying full market value or P11D value.

“You also need to consider which phones and computers will stay relevant over a long lease period. Things like iPhones and iPads probably would, but other makes may not.”

Whatever is deemed suitable for inclusion, the crucial thing is to ensure it is unique to the benefits package, says James Malia, head of employee benefits at P&MM Employee Benefits. “People are more savvy and far less impulsive, and at Christmas time, with less disposable income available, they will be even more discerning when it comes to value for money,” he says. “So the benefits you provide as an employer have to offer better quality and value for money than anything that could be found elsewhere, and you can be sure that people will go online and try to find it.”

Access to voluntary benefits plans in most large organisations is through online portals that allow employees to log into their own account and view the discounted benefits on offer, with direct links to each one.

When choosing a scheme provider, Matthew Gregson, managing consultant at Thomsons Online Benefits, suggests going for the one that offers the biggest and best discounts to the employee. “There are portals that are free or cost the employer very little to run, but because the provider still has to take a commission, the end-user, the employee, is not getting the best deal,” he says. “With a scheme that costs the employer £5 or £10 a year to run, the provider does not need to take any commission from retailers, so passes on the full discount to the members of staff.”

Maximise retail choice

Some experts suggest maximising choice by engaging a provider that has the widest range of retailers to choose from. Asperity’s Bailey says: “People’s shopping habits are diverse, but if [employers] offer the full spectrum of discounts at all the major brands, online and on the high street, they will increase their chances of having something that appeals to everyone.”

But is there such a thing as having too much choice? Neil Munroe, director at Faircare, believes there is, and that it can do more harm than good. “Choice is good as long as it is offered in a structured and well-organised way,” he says. “Too much choice will confuse employees and, ultimately, employers want to use benefits to engage employees, not put them off. The main thing is to keep benefits tailored to the workforce.”

Employee demographics, including whether staff work online or offline, their level in the organisation, types of role and even location, are factors to consider when deciding which benefits are suitable. Benefex’s Bence says: “Look at offering lifestyle benefits alongside more serious benefits that will suit a range of ages, for example gym membership or motor breakdown and life assurance, and create a balance between expensive benefits and lower-cost benefits, for example offering private medical insurance plus a cheaper alternative such as a health cash plan.”

Having assembled a package of benefits that offers something for everyone in the run-up to Christmas and the New Year, employers then need to get their communication strategy right.

Reward Consulting’s Rose says: “There will be cynics who view voluntary benefits as something they are paying for, so the employer really must get the message across that it has sourced the best benefits, the biggest savings and the highest quality from the most reputable suppliers to provide benefits that are of real value to staff as individuals.”

DISCOUNTS BOOST EMPLOYEE SPEND AND ENGAGEMENT

The economic downturn has turned the UK into a nation of bargain-hunters, according to the Halifax Home insurance study, published in August 2011:

- 90% of people are looking for ways to save cash

- 1% of people are too embarrassed to use discounts

CASE STUDY: NOTTINGHAM CITY COUNCIL

Travel savings take off for council employees

For the 10,500 or so employees at Nottingham City Council, staff discounts are the most prominent and popular part of the authority’s Works Perks benefits scheme over the festive period.

These include pre-Christmas shopping discounts available at most high-street stores, locally and nationally, and a wide array of online discounts, plus post-Christmas savings in the January sales and on summer holiday bookings. The savings that employees can make on travel bookings, often running into hundreds of pounds, can make a difference between planning a holiday in the UK or overseas.

Reward and retention consultant Tara Bath says: “Savvy employees can increase their spending power, in some cases by double or even treble, by taking advantage of in-store offers and combining these with store loyalty cards and the substantial discounts available through the Works Perks discount scheme.”

The council’s Holidayplus scheme for buying additional leave also has an application window during the pre-Christmas period, enabling employees to start thinking about their holiday plans for the following year.

“Consolidating the employee benefits provision through a single provider, on a single web platform and all under the Works Perks internal brand, is a major benefit in itself, making it much easier to raise awareness and drive usage and take-up of the scheme,” Bath adds.

ADACTUS BUILDS EMPLOYEE ENGAGEMENT

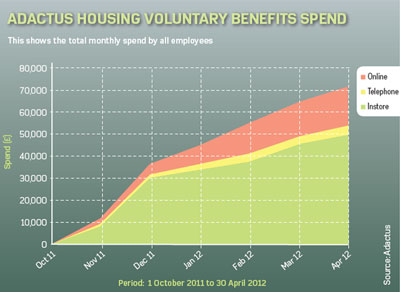

Adactus Housing saw a huge rise in employee engagement after providing festive spending cheer by launching a new voluntary benefits scheme for staff in the run-up to Christmas last year.

Launched in November 2011, the voluntary benefi ts scheme includes a broad selection of discounts and is available to the housing association’s 550-strong mixed workforce of online and offl ine employees.

Spending started to climb immediately as Adactus Housing’s employees began to take advantage of savings on their Christmas shopping spend, leading to a 60% increase in employee engagement.

Temporary workers can benefit too

Christmas is a period when many employers take on temporary and contract workers for a short period of time, so offering them access to voluntary benefi ts, such as discounted experiential perks, has strong appeal, says David Pearson, director at incentives and promotions specialist Filmology.

“This is not only a cost-effective benefi t to offer, but it also delivers signifi cant savings for the employee,” he says. “Offering easily accessible and convenient benefi ts to temporary and contract workers helps them feel valued and integral to the team, without creating extra admin for the HR department.

“A cinema ticket voucher, for example, is an inexpensive way to thank temporary workers or a large volume of staff for their efforts. The ideal benefit to show appreciation for hard work allows the recipient to choose exactly what they want.”

NOTE: Temporary staff taken on for at least six months and contract workers are entitled to equivalent benefits to permanent staff.