Younger employees are more likely to save into a pension scheme following the reforms announced in the 2014 Budget, according to research by insurer Legal and General.

Its MoneyMood research, which surveyed 578 adults aged 18 to 65, found that nearly half (48%) of respondents between the ages of 18 to 24 would be willing to save more into a pension scheme.

And more than three-quarters (43%) of respondents between the ages of 25 to 34 would be willing to save more into a pension scheme following the reforms.

However, almost the same amount (40%) of respondents in this age group would not be encouraged to save more because of the Budget reforms.

The research also found that more people are saving into a pension since the introduction of auto-enrolment.

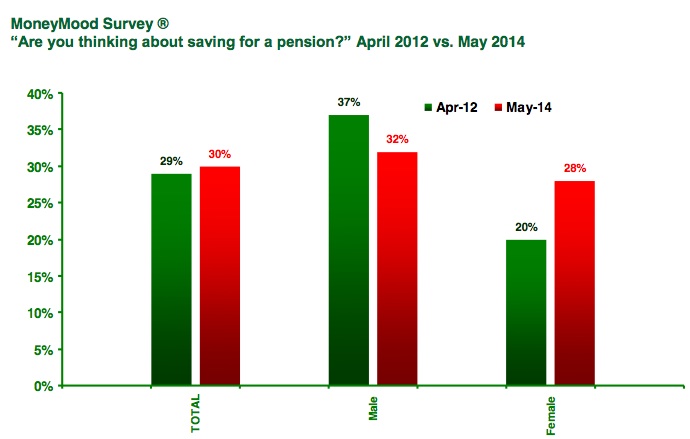

Nearly a third (30%) of respondents said they were thinking of saving into a pension, up slightly from the 29% that were considering it in April 2012 (pre-auto enrolment), when 29% were considering it.

The increase was higher among women, with 28% considering saving into a pension, a rise from 20% in April 2012.

In comparison, male respondents who are thinking of saving into a pension has dropped, from to 37% in 2012 to 37% in 2014.

Helen Buchanan (pictured), corporate managing director, marketing and distribution at Legal and General, said: “The positive response among young pension savers to the pension flexibility introduced in the Budget is a fantastic result.

“The Chancellor appears to have achieved the impossible and created a pension system that appeals to those under 35 who, until now, were the age group that tended to put off saving for their retirement.

“For the Department for Work and Pension’s auto-enrolment process there is also good news.

“The prime target for the campaign, the under-45s, appear to be nudging towards saving in a pension. And it’s encouraging to see indications that pension saving is now higher on the agenda for those aged 55 and 64 too.”