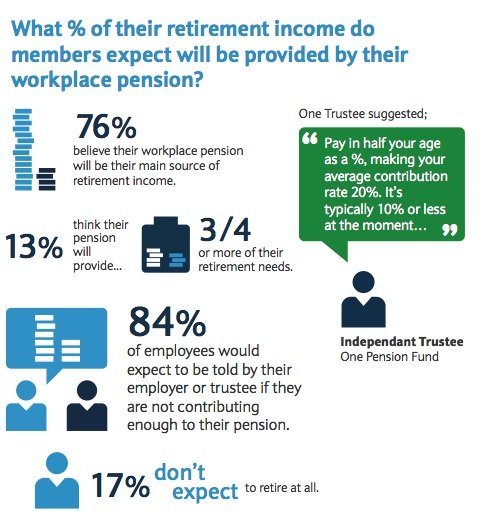

More than three-quarters (76%) of respondents expect their workplace pension scheme to be their main source of retirement income, but 88% do not believe it will meet their needs, according to research by Barclays Corporate and Employer Solutions (C&ES).

Its research, which surveyed 360 UK employees enrolled in a workplace defined contribution (DC) pension scheme, found that 84% of respondents expect to be told by their employer or trustee if they are not contributing enough.

The research also found that more than half (52%) of respondents have reviewed the investment options available to them, with 57% opting for the default investment strategy.

Just under a quarter (24%) of respondents said they remained in the default strategy because they did not feel able to make a decision.

The research also found:

- 13% of respondents do not know what their employer contributes to their pension.

- 34% of respondents expect to retire after the age of 65.

- 17% do not expect to be able to stop working at all.

Lydia Fearn, investment consultant at Barclays C&ES, said: “Trust-based defined contribution pensions are witnessing unprecedented times, in light of ever-changing pensions policy and millions of new members entering into DC pension schemes through auto-enrolment, some of which are being captured in established trust-based arrangements.

“We are keen to understand from the members’ perspective what they think about how much they need to be able to afford retirement, if this is achievable, when they would like to retire and how they select their investment strategy.

“It was particularly interesting to see a very high percentage of members expecting their employers or trustees of the schemes to tell them if they are not contributing enough to their pension.”