The rise in demand for employer-funded health cash plans since 2006 is not surprising against a backdrop of ever-decreasing National Health Service (NHS) provision.

If you read nothing else, read this…

- Employers must first identify which employees would benefit from health cash plans.

- Staff surveys and management information can then help to identify employees’ healthcare needs.

- But employers must also consider their own business objectives.

Laing and Buisson’s Health Cover UK Market Report 2013 , published in July 2013, shows that employer-funded health cash plans accounted for between one-quarter and one-fifth of total market demand in 2012, representing 588,000 employees. This share has been increasing since 2006, when it was estimated to be 8% of market demand.

But successful health cash plan implementation requires employers to align their plan with employees’ healthcare needs, which involves identifying which staff would benefit most from a health cash plan.

Brian Hall, sales and marketing director at BHSF, says: “Once upon a time, that was easy. If an employer had a blue-collar workforce, then cash plans were the product of choice. But these days, those blue-collar workers are in call centres and doing paralegal work in legal firms, and in accountancy firms, so take-up tends to be income-driven.”

Hall says employees on a basic salary of about £20,000, who have to manage their take-home pay carefully, are the target market for health cash plans.

But employers should not base their research on salary alone. “If employers have poor NHS dentistry provision locally, they’ve got to look at some way of helping their staff out,” he adds. ”If an employer has a lot of office-based workers, for example, it has to look at things like stress and eyecare .”

Staff surveys

Staff surveys, sickness absence data and management information from tools such as employee assistance programmes are perhaps the most effective methods employers can use to identify the benefits that meet their employees’ healthcare needs.

Employers should also identify their employees’ healthcare objectives.

Andy Abernethy, marketing manager at Medicash Healthcare, says: “Employers should consider what is of value to their employees. Is it giving them money back towards set healthcare treatments they can use because they are looking for peace of mind, or are they looking for something tangible?

“Do employees want peace of mind knowing they’re covered if the worse-case scenario happens, or does an employer want to give them something they will use day in, day out, and that they know they will actually see the value of during their time [with the organisation]?”

Employers must also think about their own objectives when considering a health cash plan, to help them select the most appropriate benefits for their workforce.

For example, an employer may need to consider whether its decision to provide a health cash plan is being driven by a desire to reduce its healthcare benefits spend, or to make up for a lack of pay rise for its workforce (see box).

Bespoke cash plans

Of course, employers can always invest in a bespoke health cash plan to ensure their employees’ healthcare needs are met. But this can be expensive and may not be available for smaller organisations.

Paul Shires, executive director at Westfield Health, says: “More and more cash plan providers are following this trend, and most of them will create bespoke plans for sizeable employers. But the minimum size of employer is coming down all the time; technology is helping.”

Westfield Health can provide bespoke plans for organisations with just 20 staff, as long as they choose at least two of the provider’s core healthcare benefits, which include optical, dental, therapies and consultations .

Shires adds: “As employers no longer consider health cash plans old-fashioned, penny-in the-pound hospital Saturday schemes, they are expecting more of them and want to create their own plans based around the other benefits they are providing and the specific needs of their organisation.”

Value for money should also be a consideration for employers looking at health cash plan options. Daryl Maitland, senior HR business partner at children’s social work organisation Cafcass, says: “We are constantly looking at whether we’re getting the most we can for the money we’re spending (see box).”

Management of health cash plan premiums is also key, particularly for employers that are positioning a cash plan as a more affordable healthcare benefit alongside private medical insurance. BHSF’s Hall says: “One of the things employers have to do with health cash plans, or any other benefit, is to look at long-term price stability.”

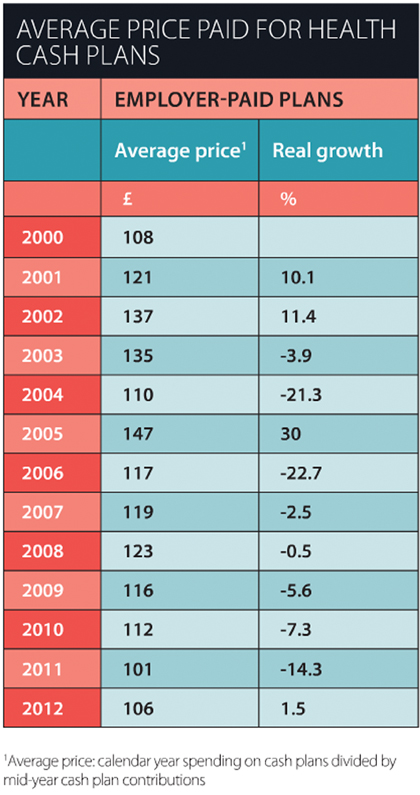

That said, the price of cash plans has fallen in recent years. Laing and Buisson’s aforementioned report shows that the average price of employer-funded cash plans stabilised at £106 per employee per year in 2012, having previously risen from £108 to £147 between 2000 and 2005.

Case study: Cafcass uses health cash plan to cut costs and reduce sickness absence

Children’s social work organisation Cafcass’s decision to implement a health cash plan was driven by three objectives: to support the wellbeing of its staff; to reward its workforce in the absence of pay rises; and to consolidate its healthcare benefits spend.

Daryl Maitland, senior HR business partner at the organisation, says: “Initially, we had a look at what we were spending on the wellbeing of our staff and a couple of things we noticed were a little worrying, or things we could improve on.”

For example, Cafcass was processing employees’ eye tests through its expenses system.

Maitland also wanted to widen its healthcare benefits provision to reach more employees. “Around 80% of what we were spending was distributed across about 20% of the workforce, so we wanted to find a way of at least offering wellbeing support more equitably, right across the workforce,” he says.

Maitland kicked off his five-month project in August 2013 with an employee survey to identify employees’ healthcare needs.

“We got a 50% response rate, which was the highest response rate we’d received through any survey at that time among our 1,850 staff,” he says. “We used that to build a specification to go out to tender with.”

The survey identified three healthcare benefits that were of value to Cafcass employees: eyecare , dental care and complementary therapies.

The organisation considered a number of health cash plan providers before appointing Medicash Healthcare in December, because of its ability to meet its workforce needs most closely. “Medicash could offer what our staff had said would be important to them, but a whole host more on top of that, which we were really pleased with,” says Maitland.

For example, Medicash offers six face-to-face counselling sessions a year for each employee through its employee assistance programme [EAP] , compared with the five offered by Cafcass’s previous EAP provider, as well as cognitive behavioural therapy, which has helped to reduce the organisation’s sickness absences rates .

Cafcass had reduced the average number of days’ sick leave its social workers took per year from 16.2 days in 2008/9 to just under seven days by April 2013, but Maitland wanted to use the health cash plan to reduce this further, to about five days. The organisation’s sickness absence rate averaged 6.76 days per employee per year in the 12 months to 30 November 2013.

Read the digital edition of our Health cash plans supplement 2014 in full.