Need to know:

- Demand for financial education is growing, with the changing pensions landscape a key driver.

- Investing in this area can help employees to engage with flexible benefits packages and potentially reduce anxiety and stress around money.

- Training is most effective when it is personalised and tailored to the specific employee demographic, and potentially also encompassing family or dependants issues.

It used to be so simple. After leaving school, an individual would get a job and then happily retire on the pension their employer had been generously contributing to every month; with the employee barely noticing or having to worry about it.

These days, of course, things are very different. Darren Laverty, sales and marketing director at financial advisory firm Foster Denovo, says: “Nowadays, the responsibility for retirement income lies firmly with the employee. The state pension may still be there, but the onus is now very much on the individual, so employers need to be empowering people with the knowledge to make good decisions.”

Pension reforms

One of the catalysts for this sea-change has been the government’s pension freedom reforms, introduced in April 2015, which give people aged over 55 the freedom to take all, or part, of their pension pot as a cash lump sum. But this is not the only driver; the decline of final salary pension provision, the government’s changes to individual savings accounts (Isas), making them potentially a much more attractive savings vehicle for retirement, and the gradual spread of pensions auto-enrolment have also been focusing minds.

And, it is clear, many employees do feel a bit at sea in this rapidly changing landscape. The Close Brothers Business barometer, published by Close Brothers Asset Management in November 2015, for example, found that nearly a fifth (17%) of employers fear their staff are confused about the new freedoms, and therefore are at risk of making poor decisions about their financial future.

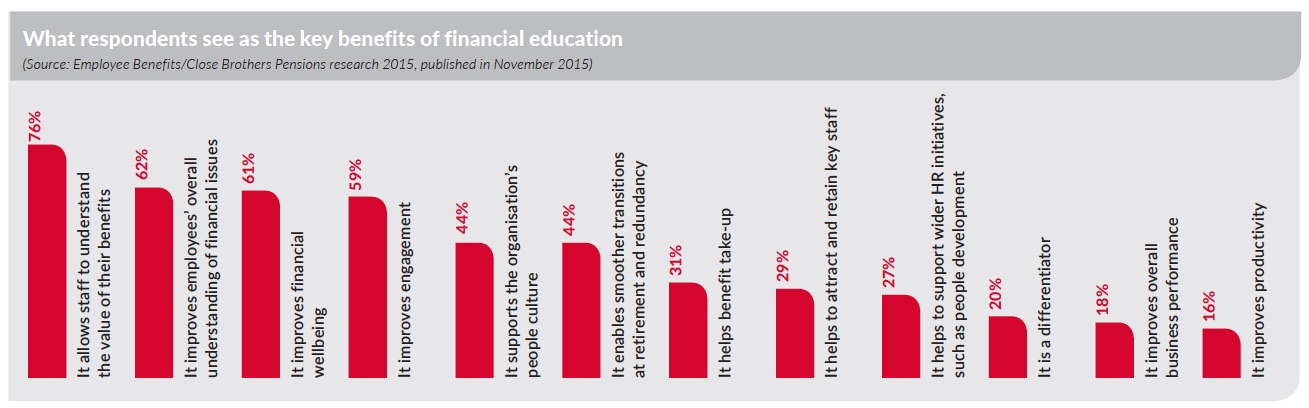

Employee benefits consultancy Jelf Employee Benefits even went so far as to predict, in its Employee benefits 2015/2016 survey in October 2015, that financial education will become the cornerstone of future benefits packages. The research found that 93% of respondents believe appetite and demand for financial education will only increase; a figure only slightly hampered by the fact 40% also admitted that they currently do nothing in this area themselves.

Jonathan Watts-Lay, director of financial education provider Wealth at Work, says: “There is an important education piece here. Even though the new freedoms have been about giving people more choice, for many it has just made the situation more complex.”

Benefits education

There is also an opportunity for financial education to complement an employer’s wider benefits offer, especially its flexible benefits package. “For example, if employees are expected to make decisions about the flex scheme in, say, February, they’re going to have some major financial decisions to take,” says Watts-Lay.

Employees are also seeking information on the changes to childcare, or equity release for elderly parents. “Or they’re wanting to know about the changes coming to the state pension or the current situation around inheritance tax,” adds Watts-Lay. “So, whereas before financial education was very much about employee x, now it can be much wider than that.”

Chris McWilliam, principal consultant at Aon Employee Benefits, adds: “We are seeing a greater take-up of, and interest in, financial education. And I do think the pensions freedom changes have kick-started that.

“The benefit for the employer is twofold. First it helps it to promote its key benefits messages, so ensuring employees understand and are making full use of the benefits being provided to them.

“Second, it can lead to a more engaged, more financially savvy, less financially worried, workforce.”

Employee wellbeing

The links between debt, money worries and stress, lower productivity and absence are increasingly well recognised by employers, says Watts-Lay. “There is a commercial cost to people having money worries. Then there’s also the cost of having employees ‘stuck’ at work because they are unable to afford to retire.”

Estate planning is another area where demand is growing, adds Foster Denovo’s Laverty. “This is something especially popular with the ‘squeezed middle’ or ‘squeezed sandwich’ generation. They perhaps still have their kids hanging about and their parents are now in a care home, and what they thought was going to be their inheritance is being eroded,” he says. “Half, we find, have often not even made a will and all their money is tied up in their property.”

Personalised information

Both employers and employees are requesting financial education to be personalised, says Tim Perkins, director of consultancy Nudge Global. “Generic information via a booklet or the office intranet does not do it,” he says. “Employers no longer want this just to tick a box; they recognise it is a real engagement opportunity. You also cannot look at [employees’] finances in isolation, it will always dovetail into what their partner needs, their children, and their dependants.

“When [an individual] has more control they make smarter decisions, which helps with wellbeing and can reduce stress, worry, anxiety and absence. There is an important corporate social responsibility piece too.”

University of Lincoln offers tailored financial education to staff

University of Lincoln offers tailored financial education to staff

The combination of pensions freedoms, reforms to the Universities’ Superannuation Scheme (USS) and The Teachers’ Pension, relatively low pay awards in recent years and the fact more academic staff now work on a sessional or contract basis means there is a huge education piece to be had around finance and financial management within higher education.

The University of Lincoln employs 1,500 core staff and around the same number again on temporary, visiting or sessional contracts. Ian Hodson, reward and benefits manager at the University of Lincoln, says: “We have really tried to embed financial wellbeing as being a strand of wellbeing generally, alongside physical and mental [wellbeing].”

In conjunction with provider Wealth at Work, the university runs four different types of tailored workshop twice a year, aimed at employees early in their career, mid-career, those closer to retirement and one for more senior staff.

“We encourage [employees] to take their own actions; it is more than just keeping track of [their] pension, it is ‘do you want to join our additional voluntary contributions (AVC) scheme, go into the USS or bring together a range of different pensions perhaps?’” says Hodson. “It is about looking at whether what [they] already have, or are doing, is going to be enough to meet [their] financial aspirations.”

The programme has proved so popular that, from this academic year, it has been extended to the university’s student population, with three programmes, each tailored to each student year.

“We recognised we actually employ a lot of our students too so things such as pensions auto-enrolment can become a factor,” says Hodson. “Often students will decide to opt out but we don’t want that to become the default, knee-jerk reaction when they come out into the jobs market. It is about getting them to think about the bigger picture, beyond just the salary.”