Employers are busy educating their workforces about the importance of saving for retirement as part of their pensions auto-enrolment duties , but few are tackling what employees should actually do at retirement and beyond.

If you read nothing else, read this…

- At-retirement education programmes should focus on employees’ desired lifestyle when they stop work.

- Employers should also consider employees who may want to work longer.

- Competent pensions managers can offer cost-effective financial education programmes in-house.

Employers should first focus on educating employees about the lifestyle changes they are likely to face in retirement.

Henry Tapper, director at actuarial partnership First Actuarial, says: “We try to help staff to understand, firstly, what it’s like not to be at work, because for most employees, it’s hard. If you talk about lifestyle things, you get them to start thinking about lifestyle change over time and they engage in that.”

In employee presentations, Tapper encourages staff to imagine retirement as a long holiday. He then asks them to consider how they will spend their time, the cost of these activities and then how, and if, they will be able to afford to meet these costs based on their current savings strategy.

Jerry Edmondson, head of communications at pensions consultancy Hymans Robertson, says this approach requires employers to consider the human aspect of retirement for their staff. “It’s not just the financial transition and financial management that members have on their agenda at retirement,” he says. “There are other things that are equally important, such as time management and health management, and there’s even relationship management. These are significant human factors that shift materially post-retirement.”

Appropriate information

Only after employers have given their staff time to understand the reality of their retirement can they introduce appropriate product information and guidance, which may include how annuities work, the different types of annuities available on the market, as well as the open market option (OMO) and income drawdown.

But employers must also consider staff that want to continue working, how they will support them to do so, whether through flexible working or in a different role, and their financial education requirements. For example, an employer may want to offer these employees access to an independent financial adviser, to help align their savings strategy with their extended working life.

Start date

Employers should start educating employees about retirement as soon as possible.

Robin Hames, head of marketing at benefits advisory firm Capita Employee Benefits, says: “If employees are given a relatively short time confronted with topics they don’t understand, their reaction is to do nothing and make a last-minute decision, which is why, quite often, there is a failure to exercise the OMO.

“Staff hide from difficult decisions they don’t understand, so a minimum of a year before an employee’s assumed retirement age is a good time to start educating them.”

Hames says employers should factor in a slow process of education that helps employees understand their options at retirement and supports them in investigating their current pension scheme membership , which may involve providing services such as the Pension Tracing Service. Staff should also be encouraged to contact their pension providers to ensure they have their correct contact information on file.

First Actuarial’s Tapper says retirement education should be an ongoing process throughout an employee’s career. “Too much focus on pensions is about saving money and building up funds, and everyone thinks that’s an end in itself and, of course, it isn’t,” he says. “Employees are saving to get to a point where they can stop working, and the key thing in all this is the replacement income ratio. Employees should start thinking about replacing their income, and that should be an ongoing process.”

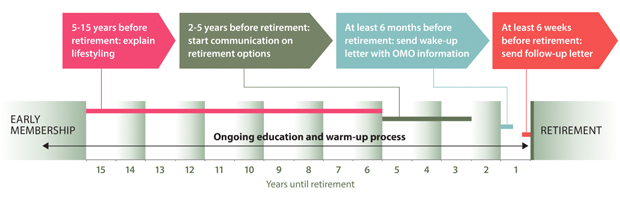

Retirement communication timeline

Source: Regulatory guidance for defined contribution schemes, The Pensions Regulator, November 2013

Holistic exercise

Tapper adds that at-retirement planning should be a holistic exercise throughout an employee’s life, not something that is confined to the last few years before they retire.

Hymans Robertson’s Edmondson says at-retirement education should ideally be a natural extension of an employee’s pre-retirement communication. “It should be more of a sequencing of touch points,” he adds.

One employer Edmondson works with has two timeframes for educating staff about retirement: five to six years before they are due to retire and five to six months ahead of retirement. “I think that’s a really good starting point, but I’d be a little bit anxious about focusing just on a couple of touch points,” he says. “Really, effective pension communications need to be a series of integrated and overlapping messaging over the entirety of a pension scheme member’s lifespan.”

He adds that in an ideal world, this messaging would be seamless, regardless of the number of employers that an employee may have during their career, but he acknowledges the challenges involved in reality, including employers’ varying views on financial education and their available budgets.

Face-to-face communication

Face-to-face financial education remains the most effective way to engage staff, particularly for communicating the complexities of at-retirement products and services.

Edmondson says: “During the halcyon days of scheme changes and shifts [from defined benefit (DB) to defined contribution (DC)], from a communications perspective, much of the messaging was around the flexibility and simplicity of DC as opposed to the arcane complexity of DB, as in ‘isn’t DC wonderful: it works like a bank account and employees just buy themselves an income to retire; simple.’ The problem is that, at retirement, the options are more complex.”

Enhanced annuities, income drawdown and open market options have never been explained effectively to employees, says Edmondson.

“There’s got be understanding, so those options need to be clearly explained, but the implications of those options need to be clearly explained as well,” he adds.

Mark Smith, head of governance and communication services at pensions advisory firm Lane Clark and Peacock, describes the process of converting a pension fund into an income in retirement as a ‘maze’.

“Employers have got to make it clear that employees have an open market option, and they need help with aggregation if they’ve got multiple pension pots,” he says.

But understanding employees’ retirement lifestyle aspirations remains employers’ first objective before they even consider where to start with product explanations. The sooner they establish this, the better, to ensure employees’ savings efforts are not jeopardised.

At-retirement options glossary

Annuity

A type of insurance policy that employees can buy from an insurer, often their pension scheme provider, at retirement using their pension savings in return for an income for life.

Enhanced annuity

Works in the same way as a standard annuity, but offers better income levels for employees in poor health, caused by illnesses such as diabetes or cancer, because of their lower life expectancy.

Open market option

This involves employees buying an annuity from the open market, which means they can choose any annuity provider, not just their current pension scheme provider.

Drawdown

This allows pension scheme members to draw down their pension while it remains invested.