The majority (91%) of respondents believe it is best for individuals to start saving into a pension in their 20s, according to research by the Money Advice Service.

The financial capability of the UK report surveyed more than 5,000 people and followed 72 families closely for a year to provide a detailed picture of how Britons manage their money today.

It found that one in seven (14%) of respondents aged under 35 believe it is better for people to start paying into a pension in their 50s rather than in their 20s. This compares with just 5% of those aged over 45.

The research also found:

- 28% of respondents pay into a pension.

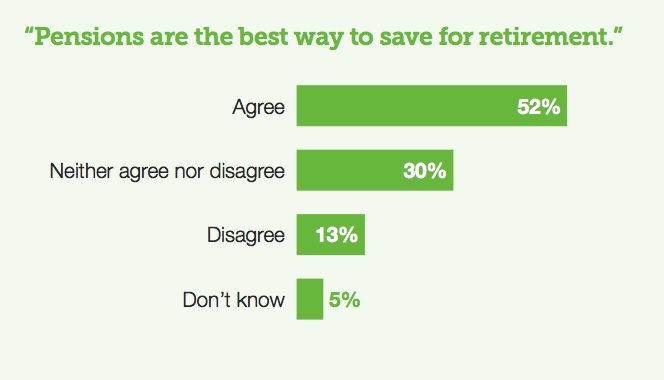

- 52% of respondents felt a pension is the best way to save for retirement, rising to 60% of those aged over 55.

- 30% of respondents neither agreed nor disagreed, suggesting that they may be open to persuasion.

Caroline Rookes, chief executive of the Money Advice Service, said: “This report draws on the Money Advice Service’s Money Lives ethnographic study and its new financial capability tracker, bringing together observational insight and quantitative evidence to explore exactly what we understand financial capability to mean, and to begin to provide a framework for its improvement.

“It is intended to provide a foundation for discussion, provide insight into the challenges faced and behaviours exhibited by people across the UK, and offer a resource to anyone involved in financial capability.

“It is an important piece of the jigsaw that, together with data collected through our recent call for evidence exercise, will contribute to the development of a UK strategy for enhancing financial capability.”